Change Employment Status Hmrc

The main people in work are employees. The changes which are already implemented for work in the public sector from April 2017 are being amended and extended to contracts for non-small clients in the private sector from April 2020.

Thanks To The New Universal Credit From The Department For Work And Pensions The Way Employers Manage Their Paye Pay Make More Money Mortgage Info Tax Credits

Theres a change in the money you earn from your job or get from your pension But you must tell HMRC about any other changes for example when you start or stop getting.

Change employment status hmrc. In this case telling HM Revenue and Customs HMRC is a statutory responsibility. The three main types of employment status are. The Demibourne case confirmed that where an employment relationship exists the employer is responsible for deducting tax from payments made to the employee in accordance with the PAYE regulations and HMRC does not have the discretion to choose whether to collect tax from the employer or the employee.

Income from a new source. A contract need not be in writing - it exists when you and your employer. The first stage in a case would usually be HMRC deciding an individuals employment status and raising a tax assessment on that basis.

If a change of address is accepted HMRC also update the Personal Tax Account for that employee. HMRC have published draft secondary legislation making amendments to Regulation 72E and F of the Income Tax Pay As You Earn Regulations 2003 in relation to the administration of the re-categorisation of workers employment status from self-employed to employed for comment by 9 March 2014 say Harris Co. The tax codes for someone changing their main job should come from form P45.

The payslip will also include a separate breakdown itemising the workers gross pay and deductions to arrive at the. Off-payroll working rules change on 6 April 2021 and are applied differently. Book a Free Consultation.

HMRC will automatically update the employee record once 3 FPS submissions have been received with the updated address and they are all displayed in the same format. This form should be given to you by your former employer. This can lead to a situation where HMRC is obliged to seek recovery of PAYE tax.

Or call us on 01604 660661. That decision would generally be subject to appeal. If your salary or pension is paid through PAYE you will be able to report the changes.

This all can make resolving employment status cases. Changes in Business Legal Structure. The appropriate page of the P45 should be given to the new employer.

All employees are entitled to an individual written payslip. Getting divorced separated or you stop living with your husband wife or civil partner. The payslip provided by the umbrella company will usually provide a breakdown of the payment received by the umbrella from the agency which itemises the umbrella company overheads including employers NICs.

The Demibourne case confirmed that where an employment relationship exists the employer is responsible for deducting tax from payments made to the employee in accordance with the PAYE regulations and HMRC does not have the discretion to choose whether to collect tax from the employer or the employee. If it is not displayed in exactly the same format the address will not be updated. This guidance has now been incorporated into HMRCs online employment status manual.

DMCA Copyright Policy. Employment status rule changes. Sign in to HMRC online services Once youve registered you can sign in for things like your personal or business tax account Self Assessment Corporation Tax PAYE for employers and VAT.

Getting married or forming a civil partnership. Reporting a Change of Business Status Certain other things can change to your business eg. The review rightly identified increasing clarity in the employment status framework as one of the major challenges for public policy.

Sometimes the issue of a P45 by the former employer is delayed. You will need to inform HM Revenue and Customs HMRC about personal changes such as. It can also be used to check if changes to contractual terms or.

Employment status is at the core of both employment law and the tax system it determines the rights that an individual gets and the taxes that they and the business they work for must pay. From this date all public authorities and medium and large-sized clients will be responsible for deciding the. The new guidance explains the changes in legislation relating to agency workers and also some changes to PAYE.

The definition of employee and worker differs slightly from one area of legislation to another but generally if rights apply to a worker they also apply to an employee. The Check Employment Status for Tax tool gives you HMRCs view of a workers employment status based on the information you provide. Its legal structure or trading activity.

Employment Status HMRC presentation Who We Are H. Youre classed as an employee if youre working under a contract of employment. But as the review highlights the current framework can often fail to provide the.

This can lead to a situation where HMRC is obliged to seek recovery of PAYE tax and NICs in relation to income from the employer.

How To Fill In Your Hmrc Tax Return Goselfemployed Co Tax Return Online Employment Employment Form

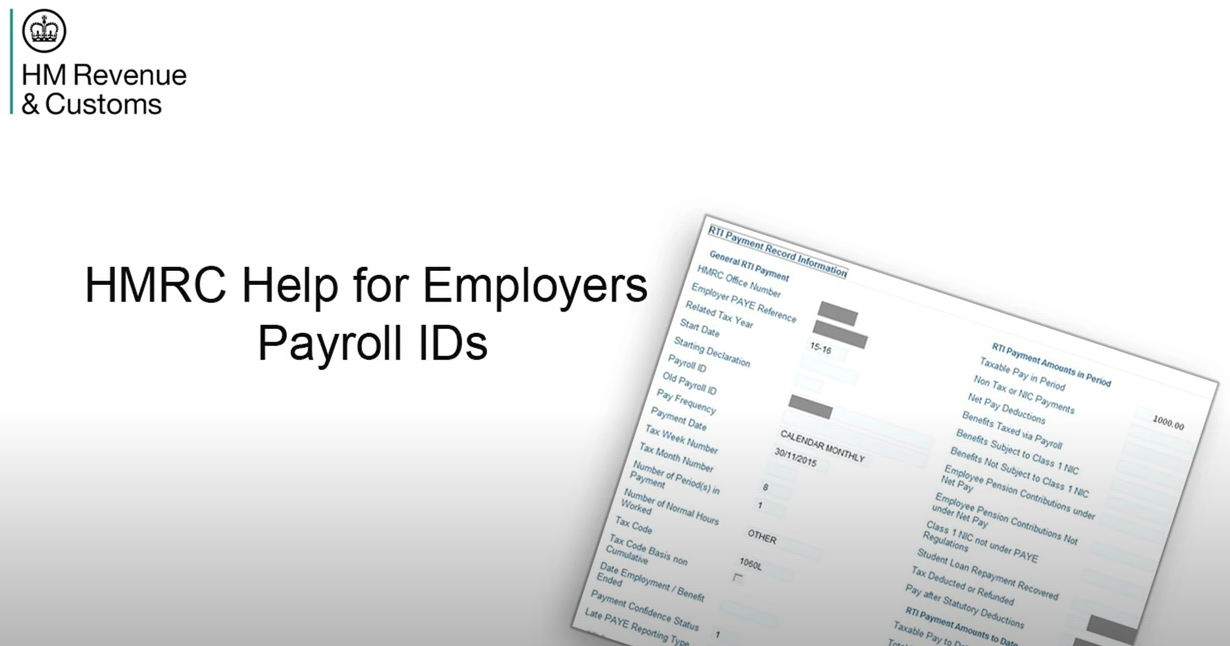

Everything You Wanted To Know About Rti Payroll Ids But Were Afraid To Ask

Ir35 Reforms Hmrc Questioned About Cest As Tax Status Of 210 000 Contractors Left Undetermined

Sa302 Tax Calculation Request Form Tax Self Assessment Request

How To Register As Self Employed In The Uk A Simple Guide

Millions Of People Missing Out On Refund From Hmrc Skint Dad Money Saving Expert Money Saving Tips Tax Refund

Hmrc Help With Online Security Youtube

How To Register For Tax As Self Employed With Hmrc In The Uk Everything You Need To Know About Ta Make Money Blogging Entrepreneur Success How To Start A Blog

Taking On A New Employee With A P45 New Employee Employee News

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Income

Hmrc Reveals Sharp Increase In Lost Self Assessment Tax Financial Times

How To Register As Self Employeduk Business Accounting Accounting Cheat Sheet Tax Help Invoice Advice In 2020 Financial Coach Woman Business Owner Independent Girls

Hmrc Sa302 Cover Letter Design 2 Cover Letter Design Self Assessment Lettering

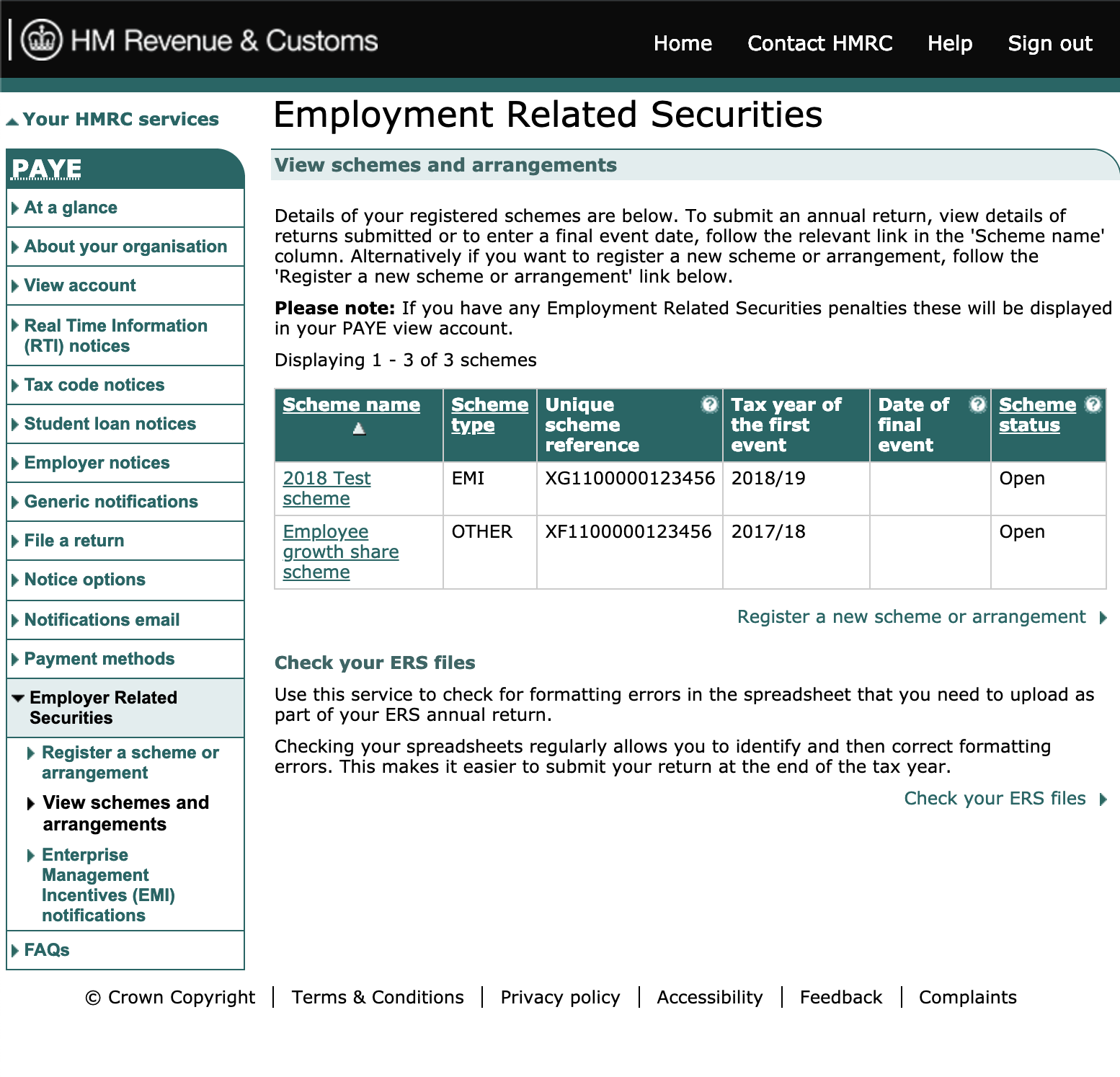

How Do I Submit A Nil Return For Unapproved Options To Hmrc

Https Www Cvonline Co Uk Wp Content Uploads 2020 10 Hmrc How To Download Guide 1 Pdf

Ir35 Nudge Letters From Hmrc What You Need To Know Boox

What Is A P6 From Hmrc Goselfemployed Co

Submit Fps To Hmrc In Quickbooks Online Standard P

Real Time Paye Infographvid From Jlpayroll And Sage Business Infographic Rti Infographic

Post a Comment for "Change Employment Status Hmrc"