How Much Tax On Rental Income In Pakistan

If your income is less than the exemption threshold of PKR 400000 whether you are a salaried or non-salaried individual you dont have to pay any income tax. For income above Rs8000000 but not exceeding Rs12000000 individuals will pay Rs1345000 plus 25 of the amount exceeding Rs8000000.

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

However there is no income tax on rental income in UAE though as per tax treaty rental income of the resident Pakistanis of their properties in UAE is to be taxed in UAE.

How much tax on rental income in pakistan. 0---PKR400000 - PKR 800000. The property is personally directly owned jointly by husband and wife. As per Federal Budget 2019-2020 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2019-2020.

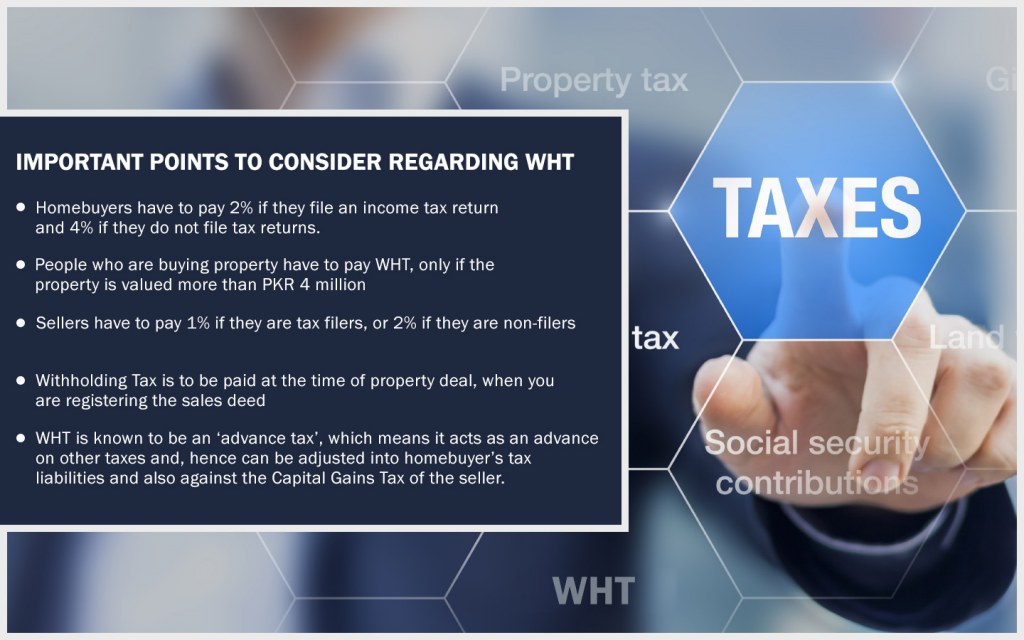

Usually a house rent allowance is around 40 to 50 percent of your basic salary. In its notification dated July 30 2019 the revenue watchdog has exempted tax on annual property rent income gross valued at Rs02 million and. The withholding agent is responsible for collecting under Section 155 of Income Tax Ordinance 2001 from recipient of rent of immovable property at the time the rent is actually paid according to withholding tax card for tax year 2019 issued by the.

Annual Income Tax Due. The HRA percentage may also vary from organisation to organisation. Tax Due as of Gross Income.

Faisal Shah 2019-2020 Budget Taxation KARACHI. The threshold has not. Jami urged the FBR to clarify whether rental income.

Renting sometimes is a better choice than buying due to the lack of your budget. The author is a tax and investment expert with 35 years experience Was this article useful. Total Income is the aggregate of Income chargeable to Tax under each head of Income.

Where the taxable salary income does not exceed Rs. 600000 the rate of income tax is 0. Both owners are foreigners and non-residents.

Suggestions For Tax On Rental Income Pakistan. From the rental income a property owner is allowed to deduct municipal taxes on the property rent that is not realised a 30 standard deduction on the annual value of the property as well as interest on the money borrowed for the renovation of the property. PKR750000 - PKR 2400000.

Rental income taxes. Globarentalsite will provide you from bike rental to car rental or you can even rent a house with our service and every kind of rental service you can find in the market. 1200000 the rate of income tax is 5 of the amount exceeding Rs.

Under the Income Tax Ordinance 2001 all Income are broadly divided into following five heads of Income. Is Income Tax applicable on all of my income. Just input your monthly rental income months to calculate your annual and monthly rental income tax liability in Pakistan for the tax year 2020.

Income from Other Sources. 2 The rent receivable during a tax year. 1 The rent received during a tax year.

PKR1500000 - PKR 4800000. Three new tax slabs are proposed for income exceeding Rs4000000 to match the maximum rate. On a basic salary of PKR 30000 you may get a house rent allowance between the range of PKR 12000 and PKR 15000.

For income above Rs12000000 but not exceedingRs30000. Up to PKR 400000. Gross rental income is US1500month.

Where the taxable salary income exceeds Rs. Federal Board of Revenue FBR has issued rate of withholding tax to be collected on income from property during Tax Year 2019. Experts at Deloitte Pakistan Chartered Accountants said that the Finance Bill 2019 proposed the increase in the number of tax slabs from five to eight.

PKR500000 - PKR 1200000. Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan. The personal income tax revenue is only 11 of GDP in Pakistan 11 of total tax revenues and only 2 of working age population is registered as taxpayer.

Register for Income Tax. Rent received or receivable by a person in a tax year is chargeable to tax under the head income from property Therefore while assessing taxable income a person has to account for. The tax levied on the average annual income on a rental apartmentproperty in the country.

For tax on rental income pakistan there are a lot of choices on our website for you to. 144000 Taxable Income. Whereas Article 241 of the Convention states the laws in force in either of the Contracting State will continue to govern the taxation of income in the respective contracting State except where provisions to the contrary are made in this Convention.

600000 but does not exceed Rs. Monthly Rental Income 2. The government has revised tax slabs for rental income from property to eight from five.

Befiler Has Set Up A Free Tax Assistance And Filing Help Desk At Luckyone Mall On The Mezzanine Floor Near Carrefour Thi Filing Taxes Free Tax Filing Tax Free

Updated Tax Provisions For Property Rental Income In Budget 2021 22 In 2021 Rental Income Budgeting Rental

New Income Tax Slabs Extra Burden On Middle Class Easy Method Of Tax Calculation In Excel Youtube Income Tax Income Excel Formula

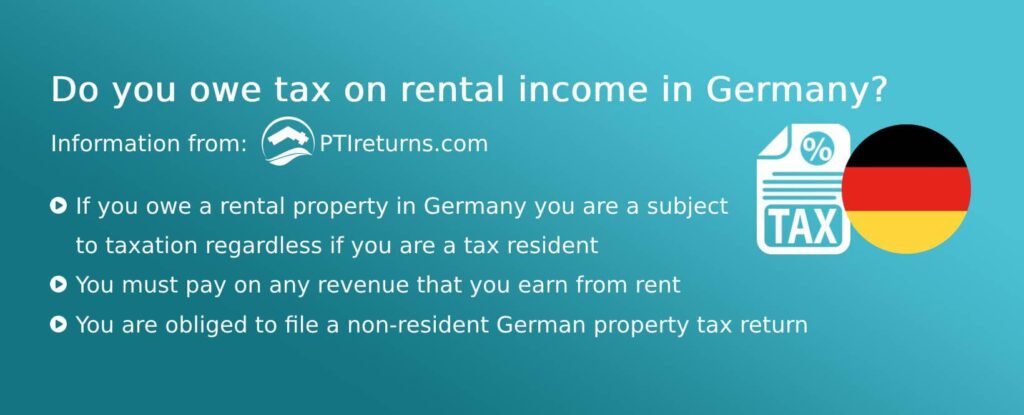

German Rental Income Tax How Much Property Tax Do I Have To Pay

Home Business Kerala Or Virtual Business Investing For Retirement Math Quiz Past Home Business Ideas Pakistan You Room Diy Diy For Teens Diy Projects For Teens

Softax Private Limited Federal Provincial Finance Acts 2018 19 Under Income Sales Tax Laws July 04 2018 Karachi In 2020 Finance Network Marketing Income

Everything You Need To Know About Property Taxes In Pakistan Zameen Blog

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Hadi Estates 5 Marla House For Sale On Cash And Easy Installments In Izmir Town Lahore Https Www Zameenforyou Online Real Estate Estates Real Estate

Get Rental Properties Details Renting A House Rental Property Rent

Grade 7 Reading Lesson 2 Short Stories Income Tax Man 2 Reading Lessons Reading Comprehension Lessons Grade 1 Reading

German Rental Income Tax How Much Property Tax Do I Have To Pay

Use The Limited Time To File Your Returns Filing Taxes Tax Services Income Tax

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

German Rental Income Tax How Much Property Tax Do I Have To Pay

Rental Income Taxes Slabs Property Sale Tax Rates Budget 2021 22 Youtube

Property Tax In Pakistan 2019 2021 Graana Com Blog

Rental Lease Agreement Pdf Lease Agreement Lease Being A Landlord

Post a Comment for "How Much Tax On Rental Income In Pakistan"