Is Rental Income Taxable In Pakistan

Income Tax is one of the important sources through which a government finances its activities. The HRA percentage may also vary from organisation to organisation.

Pakistan Budget 2021 22 Real Estate Tax Changes And Analysis

Experts at Deloitte Pakistan Chartered Accountants said that the Finance Bill 2019 proposed the increase in the number of tax slabs from five to eight.

Is rental income taxable in pakistan. The Federal Board of Revenue FBR in. In the case of AOP the tax on taxable income of Rs1200000 is Rs2000 only. Rental income taxes.

The personal income tax revenue is only 11 of GDP in Pakistan 11 of total tax revenues and only. Updated tax provisions for property rental income in budget 2021-22 Finance Act 2021 History of changes in Income Tax Ordinance 2001. 144000 Taxable Income.

The FBR updated the withholding tax card 2020-2021 after incorporating amendments to Income Tax Ordinance 2001 made through Finance Act 2020. Up to PKR 400000. 0---PKR400000 - PKR 800000.

Now for the tax year 2018 the return of total income is due where the aforesaid rental income is required to be declared. PKR750000 - PKR 2400000. Income from property is the second head of income.

Updated up to June 30 2021. 1 The rent received during a tax year. As per the provisions of section 101 of the Income Tax.

FBR has exempted tax on annual property rent income gross valued at Rs02 million and under ISLAMABAD. Income Tax is the tax that you pay on your income. Monthly Rental Income 2.

Faisal Shah 2019-2020 Budget Taxation. You must report rental income for all your properties. Just input your monthly rental income months to calculate your annual and monthly rental income tax liability in Pakistan for the tax year 2020.

Three new tax slabs are proposed for income exceeding Rs4000000 to match the maximum rate with that of the individual tax. As against this tax of Rs90000 will be chargeable on the same amount of taxable property rental income. Withholding Tax Rates Applicable Withholding Tax Rates.

If you are searching for Tax applicable on rental income. The tax levied on the average annual income on a rental apartmentproperty in the country. Finance Act 2013 shifted the property income Property rental income from fixed tax regime to normal tax.

Federal Board of Revenue FBR has updated withholding tax on rental income from immovable properties for tax year 2021. Income Tax is paid by wage earners ie salaried class self-employed and non-incorporated firms. When it announced the budget for Fiscal Year 2020-21 in June 2020 the Pakistan Tehreek-i-Insaf led government had left income taxes unchanged from last year in.

9 rows September 13 2019. Rental income is any payment you receive for the use or occupation of property. The FBR said that every prescribed persons as per Section 155 of Income Tax Ordinance 2001 shall collect deduct withholding tax from recipient of rent of immovable property at the time the rent.

The government has revised tax slabs for rental income from property to eight from five. Rent received or receivable by a person in a tax year is chargeable to tax under the head income from property Therefore while assessing taxable income a person has to account for. In addition to amounts you receive as normal rent payments there are other amounts that may be rental income and must be reported on your tax return.

Usually a house rent allowance is around 40 to 50 percent of your basic salary. On a basic salary of PKR 30000 you may get a house rent allowance between the range of PKR 12000 and PKR 15000. Non-resident couples joint monthly rental income 1.

PKR500000 - PKR 1200000.

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 2 D Income Tax Filing Taxes Tax Services

New Income Tax Slabs Extra Burden On Middle Class Easy Method Of Tax Calculation In Excel Youtube Income Tax Income Excel Formula

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Grade 7 Reading Lesson 2 Short Stories Income Tax Man 2 Reading Lessons Reading Comprehension Lessons Grade 1 Reading

Consultants In Pakistan Real Estate Property Property Real Estate Pakistan Home

Budget 2020 Affordable Homes Get Tax Holiday Boost Income Tax Tax Payment Tax Attorney

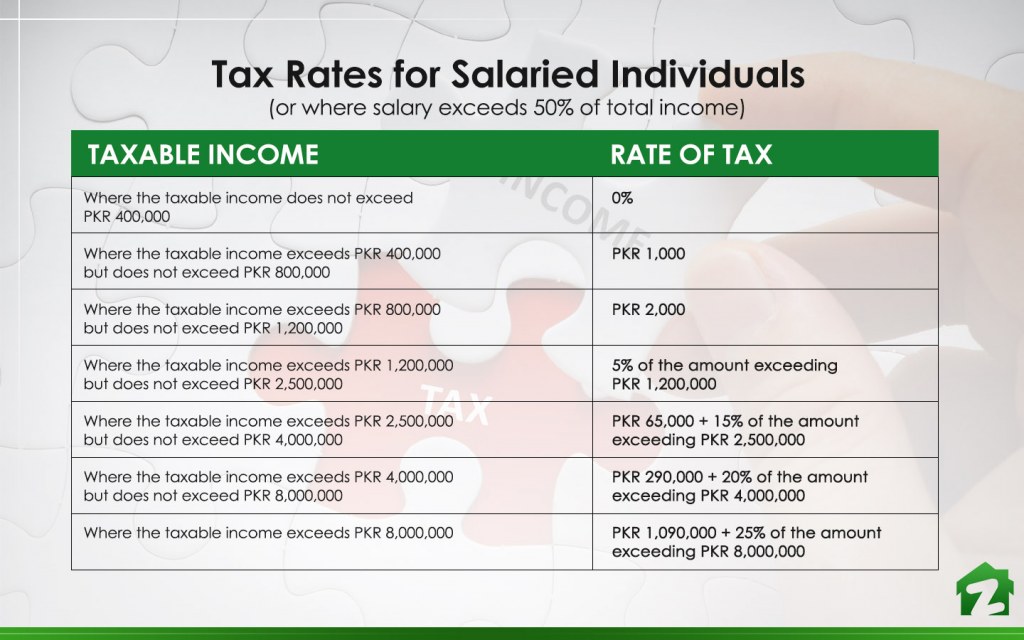

All About Tax Brackets In Pakistan For 2019 Zameen Blog

Rental Income Taxes Slabs Property Sale Tax Rates Budget 2021 22 Youtube

Home Business Kerala Or Virtual Business Investing For Retirement Math Quiz Past Home Business Ideas Pakistan You Room Diy Diy For Teens Diy Projects For Teens

Surcharge For Atl Tax Challan To Become A Filer Federal Board Make Business Online Earning

Rental Lease Agreement Pdf Lease Agreement Lease Being A Landlord

Updated Tax Provisions For Property Rental Income In Budget 2021 22 In 2021 Rental Income Budgeting Rental

Fbr Tax Chart 2019 Fbr Imposes Tax On Salary Rental Property Business In Pakistan Youtube

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

Property Tax In Pakistan 2019 2021 Graana Com Blog

Use The Limited Time To File Your Returns Filing Taxes Tax Services Income Tax

Post a Comment for "Is Rental Income Taxable In Pakistan"