Tax Rate Card 2020-21 Pakistan

This income tax calculator Pakistan helps you to calculate salary monthlyyearly payable income tax. The tax rate shall be 5 percent of the amount exceeding Rs.

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Financial Management Rate

The tax rate shall be zero percent.

Tax rate card 2020-21 pakistan. According to the income tax slabs for FY 2021-22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600000- per annum. Where the taxable salary income exceeds Rs. The FBR updated the withholding tax card 2020-2021 after incorporating amendments to Income Tax Ordinance 2001 made through Finance Act 2020.

12000000 but does not exceed Rs. Where taxable income exceeds Rs. Following are the tax slabs for salaried persons to be applicable during tax year 2021 20202021.

Pakistan Tax Card for the Tax Year 2020-21. If it will be collected then all of the poorer classes will be given relief and benefits. 2345000 275 of the amount exceeding Rs.

For the Year 2020. Latest Income Tax Slab Rates in Pakistan. In case if observed any please use comment box to inform us.

Tax Card has been prepared by ZMK Tax department for the Tax Year 2019-20 This card was prepared keeping in view recent amendments in Income Tax Ordinance 2001 through Finance Act 2019. Previously this salary slab was not included in the income tax deduction bracket. Updated up to June 30 2021.

Finally Income Tax Slab Rates for Salaried Class in Pakistan 2021-22 has published in the month of June. 600000 but does not exceed Rs. Section Relevant summary of WHT section Tax Rate Who will deduct collect agent From whom When Time of deposit Taxation Status Withholding Tax Regime Income Tax Under the Income Tax Ordinance 2001 Withholding Income Tax Rates Card Updated up to 30-06-2020 Facilitation Guide.

A 35 for Branch Office. A Oil marketing companies Oil refineries Sui Southern Gas Company Limited and Sui Northern Gas Pipelines Limited for the cases where annual turnover exceeds rupees one billion. Pakistan Tax Card for the Tax Year 2019-20.

Withholding Tax Rates Applicable Withholding Tax Rates. The National Assembly approved the Finance Bill 2020 with certain amendments proposed therein and after the assent of the President of Pakistan Finance Act 2020 has been enacted on 30 June 2020. The FBR said that every prescribed persons as per Section 155 of Income Tax Ordinance 2001 shall collect deduct withholding tax from recipient of rent of immovable property at the time the rent is actually paid.

Tax Card 2020 6. B No Tax for Liaison Office as commercial activity not allowed. Now lets learn more about the latest tax.

721 576 66 7. FBR TAX CARD 2020 FOR PAKISTAN Finance Act 2019. As a regular annual practice we have prepared our Tax Rate Card for 2020-21.

Persons Minimum Tax as percentage of the persons turnover for the year 1. 1 7 10 2 07 7 0267 05. Diligent care was taken in the preparation of this card though error omissions expected.

57. In case if observed. Tax Rates For Salaried Individuals Salary Income Rs Sale of goods Filer Non- filer Up to 600000 By company 4 8 6000001 to 1200000 By Individual and AOP 45 9.

12000000 but does not exceed PKR. This publication contains a review of changes made in Income Tax Ordinance 2001 Sales Tax Act 1990 Federal Excise Act. 30000000 then the rate of income tax is PKR.

This will help and let us to smoother up the flow of our money that also effects on the economy. This rate card is prepared on the basis of Finance Act 2020 and the changes it has brought about in Income Tax and Sales Tax. 2345000 275 of the amount.

B Pakistan International Airlines Corporation. And treatment of withholding income tax taking into account the amendments vide the Finance Act 2019 the Act. 30000000 the rate of income tax is Rs.

Add Income Tax Calculator Pakistan 2020 - 21 to your. Taxed for the profits at the following rates. SrNo Title 1 Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021.

Calculate your Tax on Salary Tax on Monthly Rent Tax on Business Income and Tax on Agriculture Income in Pakistan-Income Tax Calculator for years 2021-2022. In addition to this the changes occurred due to. The information summarized herein is general and based on our interpretation of the Income Tax Ordinance 2001 and significant amendments thereto vide the Act effective from July 01 2019becoming Tax ie.

Where taxable income does not exceed Rs. If the annual salary income exceeds PKR. Diligent care was taken in the preparation of this card though error omissions expected.

FBR Income Tax Slabs for Salaried Persons 2021-22. Tax Card has been prepared by ZMK Tax department for the Tax Year 2020-21.

Youtube Make Business L Information Change Email

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Chart Tax Deducted At Source Rate

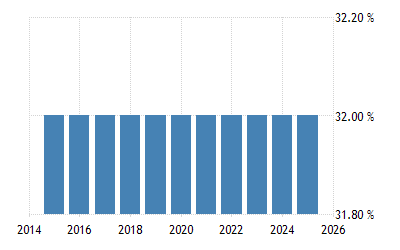

Poland Personal Income Tax Rate 1995 2021 Data 2022 2023 Forecast Historical

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Salary Tax Calculator Pakistan 2020 2021 Business Software And Accounting Training Tutorial

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Financial Management Rate

New Income Tax Rates Calculation Fy 2020 21 Income Tax Slabs Income Tax Calculator 2020 21 Youtube

Income Tax Deductions Under Chapter Vi For Ay 2020 21 Fy 2019 20 Sec 80c 80ccc Etc Deduction Tax Deductions Best Money Saving Tips

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

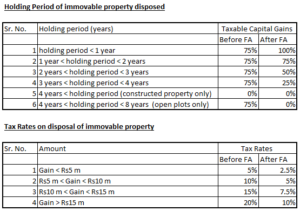

Fbr Significantly Changes The Taxation Of Capital Gains On Disposal Of Immovable Property Profit By Pakistan Today

Tax Card For Tax Year 2020 All Pak Notifications

Pesco Issued List Of Regular Employees List Employee Peshawar

Income Tax Return 2020 Fraud Bisp Online 2700 Officers Bad News For Income Tax Return Income Tax Tax Return

1 Tds Rate Chart Fy 2019 20 Ay 2019 20 Notes To Tds Rate Chart Fy 2019 20 Ay 2020 21 No Tds Chart Rate Tax Deducted At Source

Bridal Dress Blue Golden Combo Brautkleid Langes Abendkleid Hochzeitskleid

Circular No 02 07 2018 Public Dated Islamabad The 1st February 2019 Regarding Bank Holiday With All Public Holidays Year Calendar Public Holidays Holiday Day

Newspaper Tender Bio Degradable Pakistan Navy Maven Pk Smart Digital Marketing Digital Marketing Tenders Marketing

Post a Comment for "Tax Rate Card 2020-21 Pakistan"