What Are The Tax Percentages For 2021

However as they are every year the. Non-taxpayer including children and Scottish Starter rate.

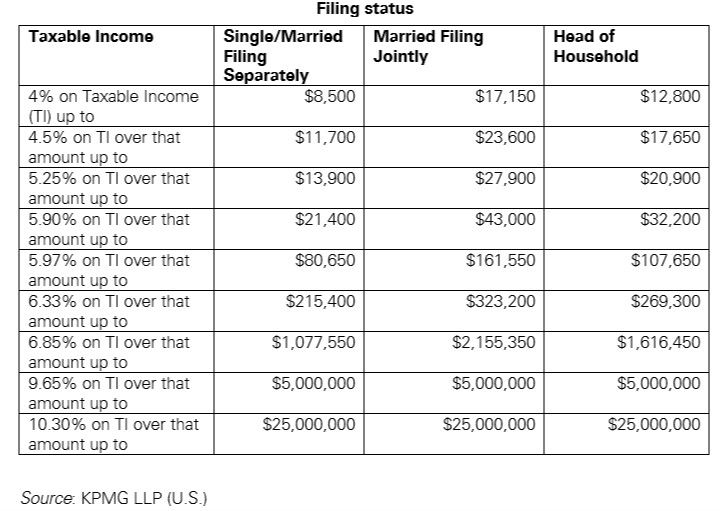

Us New York Implements New Tax Rates Kpmg Global

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range.

What are the tax percentages for 2021. This includes income from self-employment or renting out property and some overseas income. So your effective tax rate will actually look like this. Your bracket depends on your taxable income and.

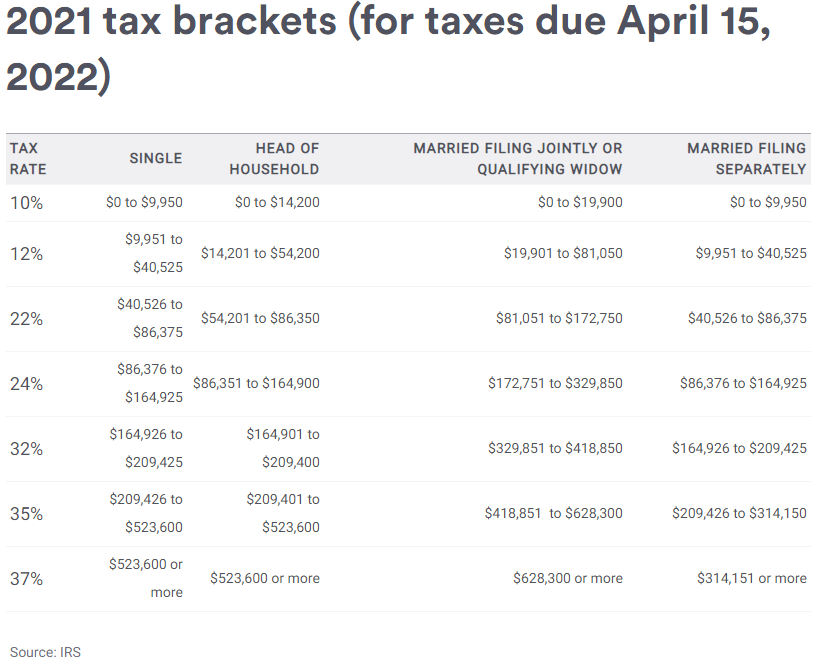

Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly.

The amount of tax you pay depends on your total income for the tax year. 22 x 9875 50000 - 40125 217250. The 19 rate ceiling lifted from 37000 to 45000.

The other rates are. Your income is taxed at a fixed rate for all income within certain brackets. Individuals and special trusts Taxable Income.

The 325 tax bracket ceiling lifted from 90000 to 120000. R 205 901 R 321 600. 75901 to 153100 28.

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. The tax rate is based on withholdings chosen on the employees W-4 form. The other rates are.

The rates increase as your income increases. For example a married couple filing jointly and making 160000 would have been in the 28 tax bracket for 2017. 6790 Effective Tax Rate.

2021 Standard Deduction and Personal Exemption. Using the chart you find that the. R 67 144 31 of amount above R 321 600 R 445 101 R 584 200.

New Zealand has progressive or gradual tax rates. Last updated 10 May 2021 show all updates 10 May 2021 Percentage rates for petrol-powered and hybrid-powered cars for the tax year 2021 to 2022 have been added. Tax status Tax relief 202122 Net cost of 1000 gross contribution 202122.

For 2018 they move down to the 22 bracket. Taxable Income. 10 12 22 24 32 35 and 37.

INDIVIDUALS AND TRUSTS Tax rates from 1 March 2021 to 28 February 2022. Overall percentages are lower than in 2017 and the ranges for each percentage are also lower producing tax savings for each group. 12 x 30250 40125 - 9875 3630.

For a taxpayer with taxable income of 45000 the tax saving is 1080. Tax Brackets for income earned in 2021 37 for incomes over 523600 628300 for married couples filing jointly 35 for incomes over 209425 418850 for married couples filing jointly 32 for incomes over 164925 329850 for married couples filing jointly 24 for incomes over 86375 172750 for married couples filing jointly. There are seven tax rates in effect for both the 2021 and 2020 tax years.

10 x 9875 98750. In most cases youll be credited back 54 of this amount for paying your state taxes on time resulting in a net tax of 06. You pay tax on this income at the end of the tax year.

This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 202122. For a taxpayer with taxable income of exactly 120000 the saving is 2430. 7 rows 2021 Tax Brackets Due April 2022 Tax rate Single filers Married filing jointly Married.

R 0 - R 205 900. R 37 062 26 of amount above R 205 900 R 321 601 R 445 100. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly.

From 1 April 2021. SEE MORE IRS Releases Income Tax Brackets for 2021 However which one of those capital gains rates 0 15 or 20 applies to you depends on. This 6 federal tax is to cover unemployment.

There are seven federal tax brackets for the 2020 tax year. 10 12 22 24 32 35 and 37.

New York State Enacts Tax Increases In Budget Grant Thornton

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

2020 2021 Federal Income Tax Brackets

25 Percent Corporate Income Tax Rate Details Analysis

2021 Federal Tax Brackets What Is My Tax Bracket

What You Need To Know About Capital Gains Tax

How The Tcja Tax Law Affects Your Personal Finances

2021 Federal Tax Brackets What Is My Tax Bracket

What S Your Tax Rate For Crypto Capital Gains

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Much Does A Small Business Pay In Taxes

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Post a Comment for "What Are The Tax Percentages For 2021"