Withholding Income Tax Regime (wht Rates Card) 2020-21

Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Agents -as per Finance Supplementary Second Amendment Act 2019 updated up to March 09 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding.

Federal Board of Revenue FBR has issued updated withholding tax card for salary income to be prevailed during Tax Year 2021 2020-2021.

Withholding income tax regime (wht rates card) 2020-21. It is payable by companies that are registered in Nigeria and non- resident entities carrying on business in Nigeria. In addition to this the changes occurred due to Provincial Finance Acts are also mentioned in this Rates Card. August 2 2020.

This Rate Card may be downloaded from Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2019 APPLICABLE FOR TAX YEAR 2020 Nature of Payment Persons Tax Rate Nature of Tax Advance Final Minimum Tax appearing in ATL Person not appearing in ATL Page 5 EXPORTS. Sale of cigarettes pharma products. Deductions against Income from House Property The Act has restored the scheme of taxation for Individual and AOP from separate block of taxation to net income basis.

COMPANY INCOME TAX CIT The principal law is the Companies Income Tax Act CITA which imposes CIT on profits accruing in derived from brought into or received in Nigeria. In case if observed any please use comment box to inform us. Income Tax Exemption Certificates Download Financial Budget for 2020-21 Download Withholding Income Tax Regime WHT Rates Card Download Classification Sheet of Income Tax Sales Tax Download Budget 2018-19 Download Pension Notification 2018 Download.

The period for filing WHT is 21 days after the duty to deduct arose for deductions from companies. Applicable Withholding Tax Rates. Diligent care was taken in the preparation of this card though error omissions expected.

Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021 Stay Connected Facebook. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. G orxu ploov dqg h hdohuv dqg vxe ghdohuv ri vxjdu fhphqw dqg hgleoh rlo rqo wkrvh dsshdulqj rq 7 0rwruffoh ghdohuv 6dohv 7d 5hjlvwhuhg q doo rwkhu fdvhv 6hfwlrq dlq lq glvsrvdo ri dvvhwv rxwvlgh 3dnlvwdq.

The FBR issued the withholding tax card 2020-2021 updated up to June 30 2020 after incorporating amendment made to Income Tax Ordinance 2001. Updated up to June 30 2020. Foreign produced commercials Sec 235B Sec 153120 Final Tax SUPPLY OF GOODS S1531a Div.

As a background until 2016 income from house property in both cases were on. Taxpayers are desperately waiting for the new Withholding Income Tax Regime WHT Rates Card to be. Withholding income tax regime wht rates card guideline for the taxpayers tax collectors withholding tax agents - as per finance act 2020 updated up to june 30 2020 1 files 99084 KB Download.

Official Email FBR Employees Government Links. This rate card is prepared on the basis of Finance Act 2020 and the changes it has brought about in Income Tax and Sales Tax. III PIII 1stSch Cl 24A 24C P II 2ndSch Sale of rice cottonseed oil edible oil 15 3 Advance Tax for Listed companies and Companies Engaged in Manu-facturing.

The original Statue Income Tax Ordinance 2001 as amended shall always prevail in case of any contradictionerror herein. Items Comments Rate S 401 30 Small Company tax. Disclaimer- This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

Minimum Tax for other cases. The tax payable by such company shall be equal to 75 US cents per ton of gross registered tonnage per annum. As a regular annual practice we have prepared our Tax Rate Card for 2020-21.

The penalty for failure to deduct or remit tax is 10 of the amount not deductedremitted. Tax Card has been prepared by ZMK Tax department for the Tax Year 2020-21. Pakistan Tax Card for the Tax Year 2020-21.

This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

New Income Tax Rates Over Old Rates Personal Finance Amazing Reveal

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

5 Key Changes In Income Tax Rules You Should Know

Taxes In France A Complete Guide For Expats Expatica

Income Tax On Revenue From Youtube

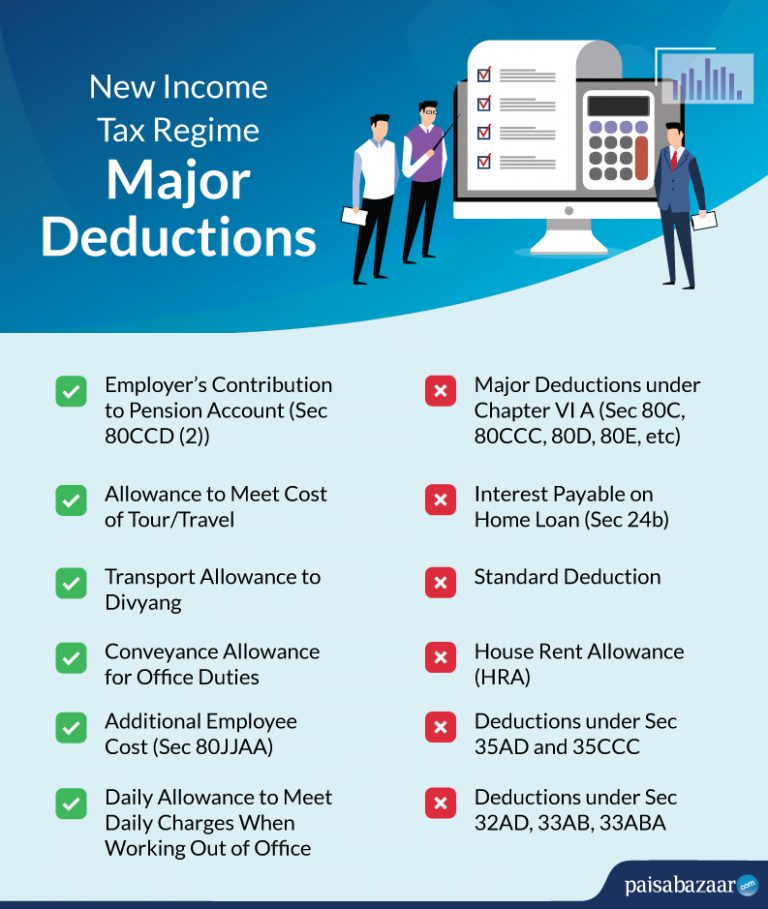

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

Comparison Of The New Income Tax Regime With The Old Tax Regime

Taxes In France A Complete Guide For Expats Expatica

Post a Comment for "Withholding Income Tax Regime (wht Rates Card) 2020-21"