Withholding Tax Expanded Rates

Withholding tax on qualifying interest is final. Tax rates are generally fixed but a different rate may be imposed on employers than on employees.

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

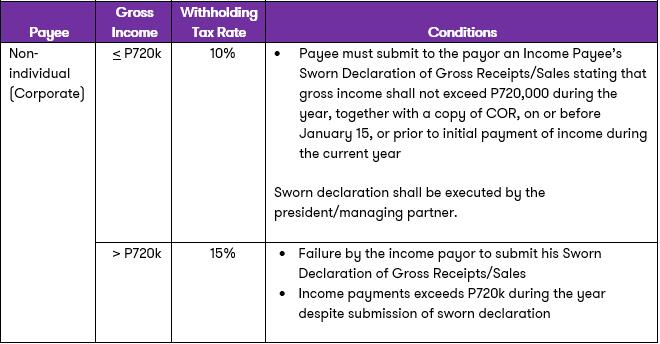

If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied.

Withholding tax expanded rates. Income tax rates used for 2008 will also apply to the 2009 and 2010 taxable years. Doubled tax benefit for investing in long-term mutual funds. Effective with returns filed after Jan.

Unlike the Federal Income Tax Michigans state income tax does not provide couples filing jointly with expanded income tax brackets. Part of this expansion is to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them. The Brazilian payer of any such amount is liable for withholding and collecting this tax on behalf of the non-resident recipient.

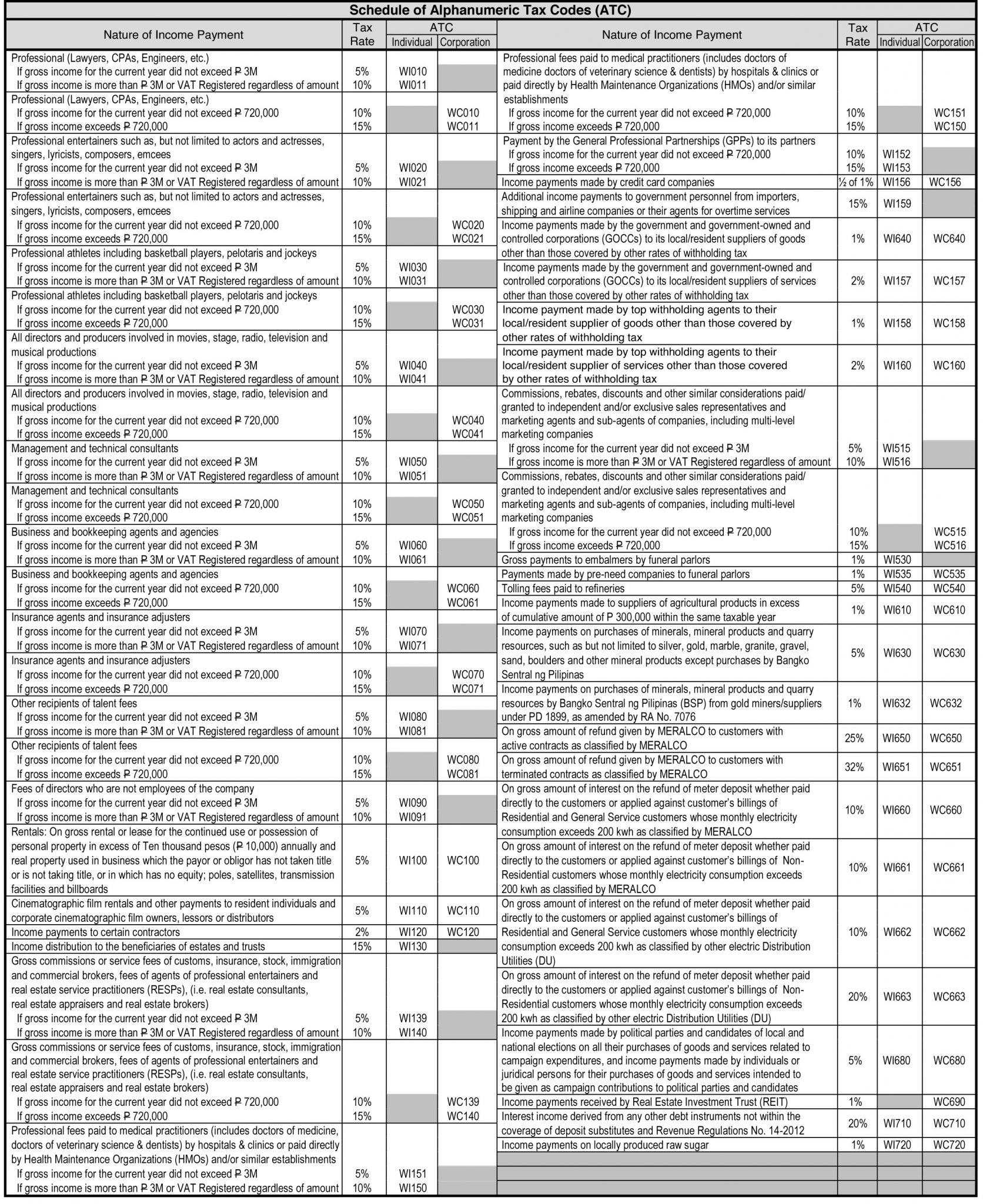

Expanded the income tax to include trusts. Non-individuals have a lower income bracket but have higher withholding rates. Quarterly Remittance Return of Creditable Income Taxes Withheld Expanded Description.

Additionally eligibility for the credit is expanded to higher-income taxpayers. Unlike the Federal Income Tax Massachusetts state income tax does not provide couples filing jointly with expanded income tax brackets. The 2017 Budget made no changes to the personal.

Tax Guide for Aliens. Massachusetts collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Final regulations on income tax withholding were published in the Federal Register on October 6 2020 at 85 FR 63019.

Liberia expanded from 106 of GDP in 2003 to 213 in 2011. Corporate income tax filing deadline extended to May 31 except for companies paying the 35 percent tax rate. The Act has expanded the definition to include all interest received by a resident individual.

Otherwise a 10 withholding tax must be applied. You can learn more about how the Massachusetts income tax. This quarterly withholding tax remittance return shall be filed in triplicate by every Withholding Agent WApayor required to deduct and withhold taxes on income payments subject to Expanded Creditable Withholding Taxes.

Michigan collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 15-T Federal Income Tax Withholding Methods. The bill also includes a temporary 500 nonrefundable credit for.

Mozambique increased from 105 of GDP in 1994 to around 177 in 2011. Circulation tax deadline extended to the end of April. Applying for a US.

505 Tax Withholding and Estimated Tax. 1179 General Rules and Specifications for Substitute Forms 1096 1098 1099 5498 and Certain Other Information Returns. Personal Income Tax deadline extended until May 17 Former Department employee indicted on federal charges Department issues guidance on 600 rebates restaurant GRT relief.

BR - BR Tax Withholding. Illinois Department of Revenue Issues Automatic Tax Refunds to Thousands of Unemployment Benefit Recipients 7152021 50000 AM Compliance Alert - Compliance and Reporting Issues for Form ST-1 Sales and Use Tax Return. To qualify for the earned income credit prior to if you dont have a qualifying child in for your 2021 tax return here are the new limits.

Michigans maximum marginal income tax rate is the 1st highest in the United States ranking directly below Michigans. As economies are rebuilt after conflicts there can be good progress in developing effective tax systems. The regulations implement changes made by the Tax Cuts and Jobs Act and reflect the redesigned withholding certificate Form W-4.

This is a positive development as it will encourage investment by individuals in various interest-bearing instruments. For the 2 years to 2019-20 and for the 2 years following the middle income 325 tax rate ceiling was lifted from 87000 to 90000. Income withholding tax cut from 3 percent to 15 percent for six months.

TIN Taxpayer ID Number Applying for a US. Notably Massachusetts has the highest maximum marginal tax bracket in the United States. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year.

1 2020 H541 of the 2019 Legislative Session changed the definition of land subject to the Land Gains Tax. How Taxes Affect. AU.

EIN for Corporations and Non-Individual Entities. Withholding responsibilities apply. The fth and nal rate reduction is now scheduled for taxable year 2011 when tax rates will be.

The child tax credit has been expanded to 2000 per qualifying child and is refundable up to 1400 subject to phaseouts. See the regulations for detailed information on income tax withholding. 51 Circular A Agricultural Employers Tax Guide.

The phase-in and phaseout rates also doubled and for tax year 2021 is 153 up from 765. If the gross income for the year does not exceed P720000 then a 10 withholding is required. Future tax rates of course depend on the current legislation remaining unchanged.

The current tax scale is the result of a number of tax scale adjustments set forth in the Budgets of 2018 and 2019. The BITR also imposes a withholding tax on remittances abroad such as interest payments rents royalties and services fees at rates varying from 6 to 25. Direct cash support to 3 million people.

Tax Rates 2017-2018 Year Residents The 2018 financial year starts on 1 July 2017 and ends on 30 June 2018. Under the revised definition Vermont land is only subject to the tax when it has been purchased and subdivided by the transferor within six years prior to the sale or exchange of the land. The Child Tax Credit has been expanded by the American Rescue Plan Act that was enacted in March of 2021.

Expanded Withholding Tax Ewt Business Software Computes For Ewt

Welcome To The Withholding Tax System The Withholding

Welcome To The Withholding Tax System The Withholding

Expanded Withholding Tax Ewt In The Philippines

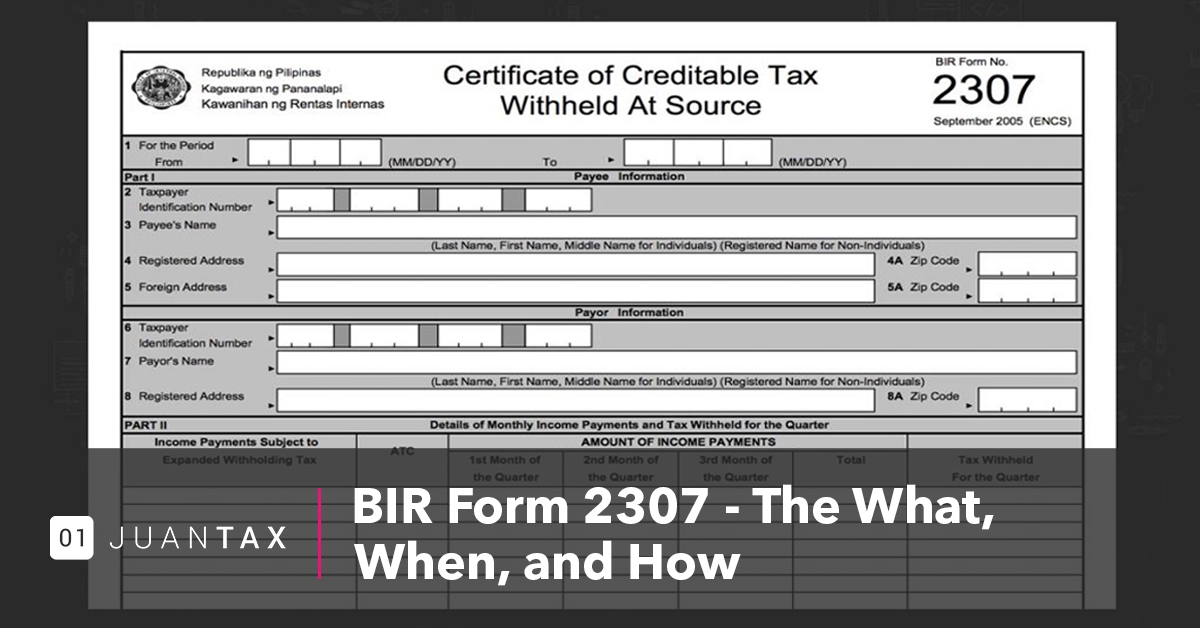

Bir Form 2307 The What When And How

Effects And Influences Of The Withholding Tax

Revised Withholding Tax Table For Compensation Tax Table Withholding Tax Table Tax

Train Series Part 4 Amendments To Withholding Tax Regulations Zico Law

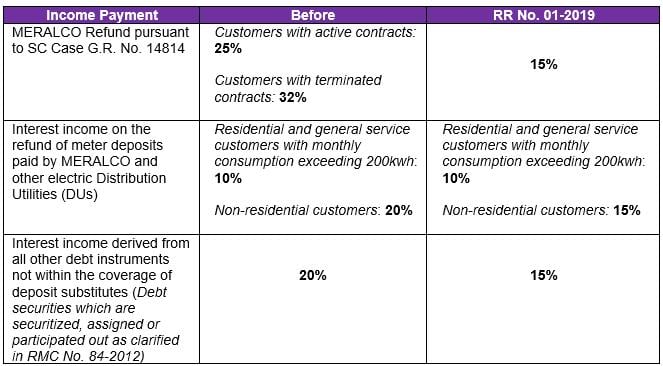

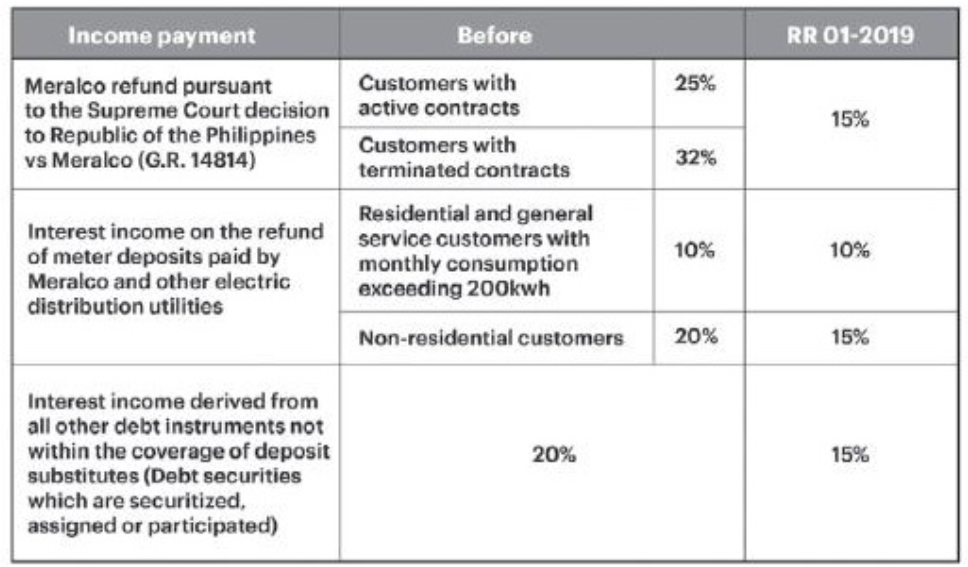

Updated Withholding Tax Rates On Meralco Payments And Interest On Loans Grant Thornton

How To Compute Expanded Withholding Tax In The Philippines Business Tips Philippines

Welcome To The Withholding Tax System The Withholding

Expanded Withholding Tax Under Train Law Reliabooks

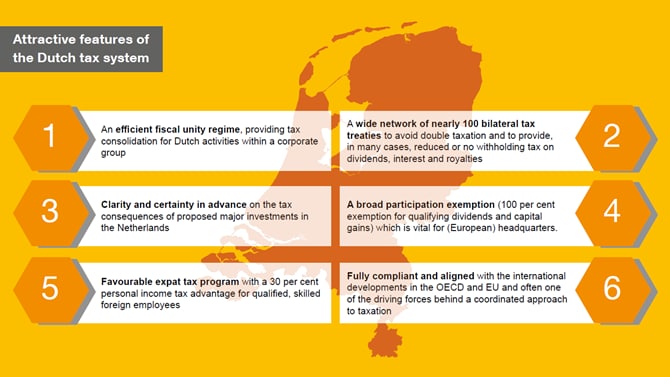

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

How To Compute Expanded Withholding Tax In The Philippines Business Tips Philippines

Welcome To The Withholding Tax System The Withholding

New Withholding Tax Rates On Meralco Payments And Interest On Loans Grant Thornton

Withholding Tax On Professional Fees Under Train Law Reliabooks

What Is Withholding Tax And When To Pay It In Singapore Singaporelegaladvice Com

Post a Comment for "Withholding Tax Expanded Rates"