Withholding Tax Rates Canada By Country

Here is the withholding tax rate for some of the largest countries. The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect.

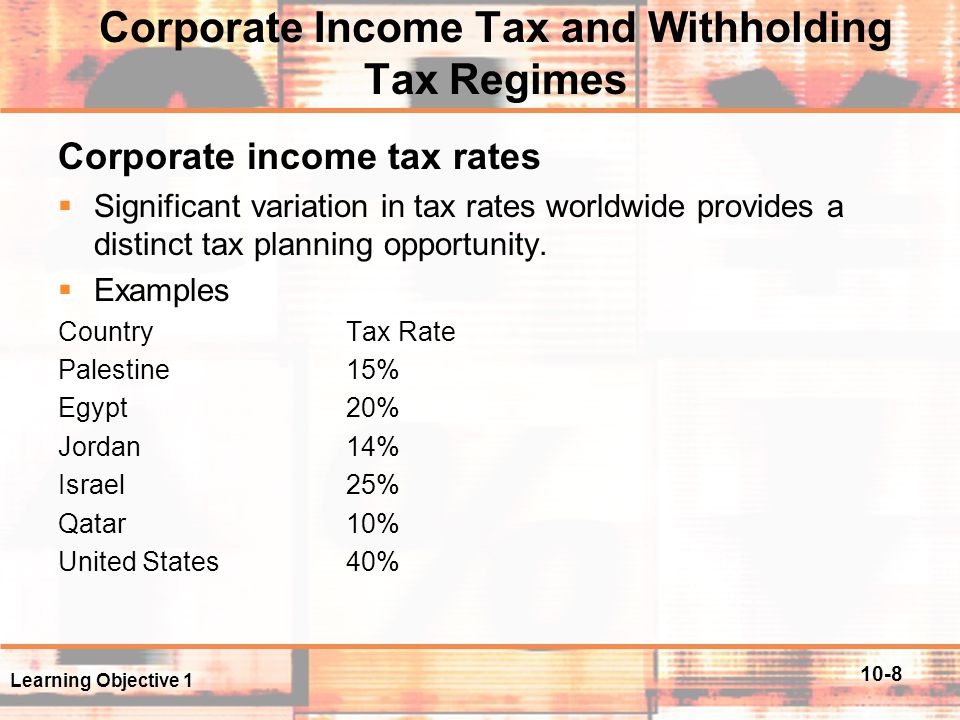

International Taxation Ppt Download

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Withholding tax rates canada by country. 25 15 effective rate for Americans due to tax treaty China mainland. Corporate - Withholding taxes. A special tax treaty between Canada and the US.

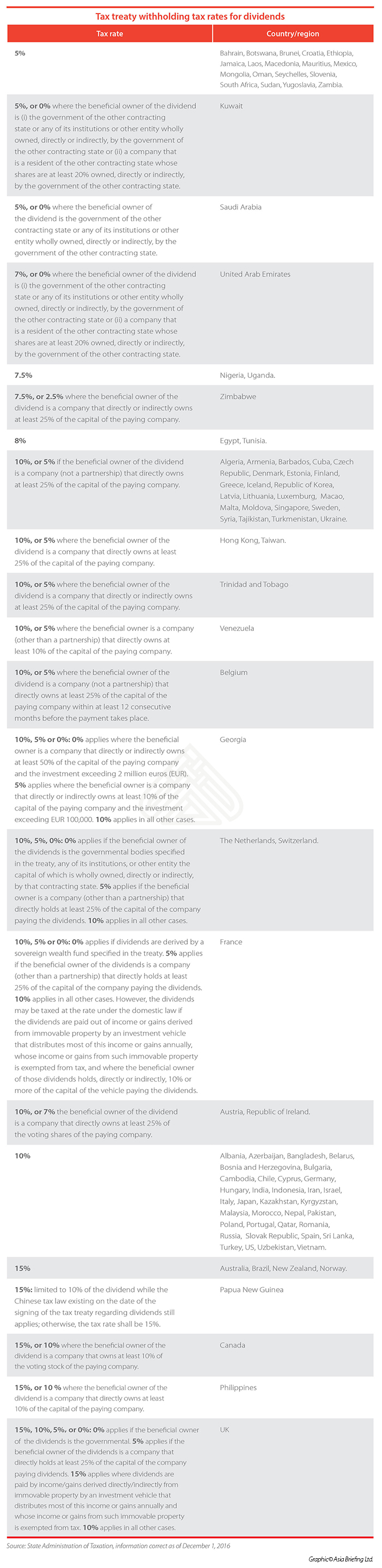

In Switzerland there is no WHT on interest deriving from regular loan agreements. Swiss WHT of 35 is only levied on interest paid by banking institutions or paid by entities tax-wise qualified as banking institutions to non-banks interest on bonds and interest on bond-like loans. Foreign Dividend Withholding Tax Rates by Country.

132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. This table shows withholding tax rates for stocks held in regular brokerage accounts only.

For more information about rates of non-resident withholding tax for the various countries or regions with which Canada has tax treaties go to Non-Resident Tax Calculator see Information Circular IC76-12R6 Applicable rate of part XIII tax on amounts paid or credited to persons in countries with which Canada has a tax convention and Information Circular IC77-16R4 Non-Resident Income Tax. This simple one-page is useful to any investor holding foreign stocks and receiving dividend income. This table shows the tax rate that applies to your country of residence as well as any applicable exemption.

Corporate - Withholding taxes. 15 10 30 unless rates provided by Double tax treaties. Payments to residents of treaty countries 8 3.

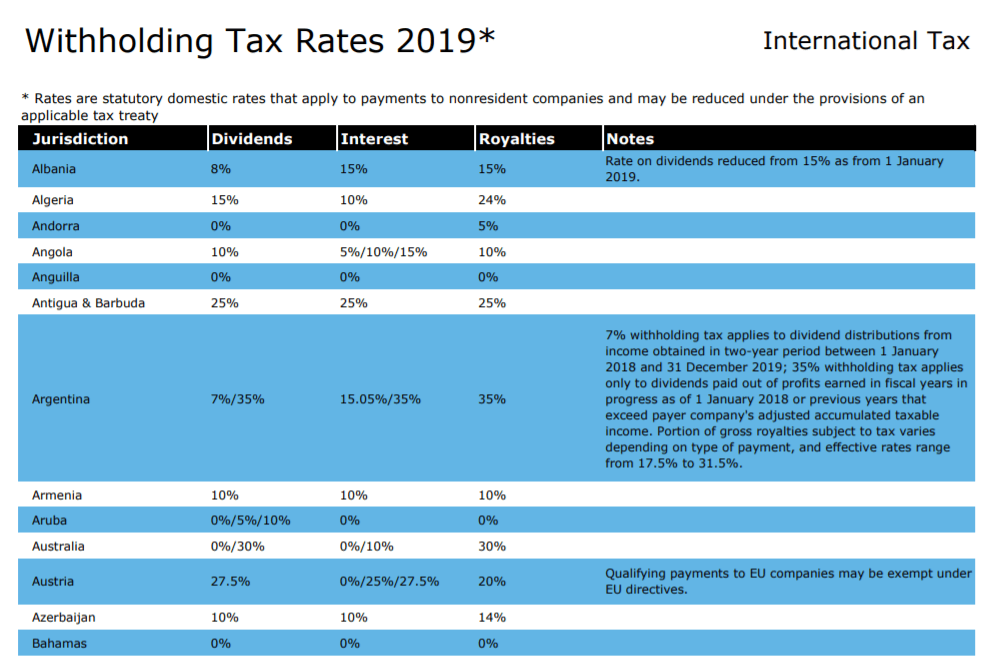

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Credit for the unrelieved portion of Swiss WHT may be available in the country of the recipient. The Act provides for a withholding tax of 25 on Canadian pension benefits paid to nonresidents of Canada.

For questions about your taxes contact the Canada Revenue Agency. Specific exceptions are noted in paragraph 2121h of the Act. Even Canada has a withholding tax.

The standard non-resident tax rate is 25. 15 10 0 but VAT 19 unless exempted. Angola Last reviewed 24 June 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola.

These rates range from as low as 0 in Hong Kong to as high as 35 in Chile. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax. Rates of Canadian withholding tax applicable to interest dividend and trust income 8 241.

Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS. Last reviewed - 06 February 2021. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain management and technical service fees and similar payments made by a Canadian resident to a non-resident of Canada.

Reduces the foreign withholding tax levied on Canadians from 30 to 15. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. Author long BNS and RY.

Click to download the Withholding Tax Rates by Country document in pdf. We charge foreign investors 25 of the dividends they earn from Canadian companies. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on.

Payments to residents of non-treaty countries 8 242. The foreign withholding rate can vary wildly. The rate of withholding tax may be reduced or eliminated by a tax convention between Canada and the individuals country of residence.

The list focuses on the main indicative types of taxes. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. Most interest payments made on or after January 1 2008 9 32.

A Part XIII tax rate of 23 applies to the gross amounts paid credited or included as a benefit for acting services rendered in Canada by a non-resident actor including payments of residuals and contingent compensation. Exemptions from withholding tax 9 31. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US.

The Dividend Withholding Tax Rates by Country for 2020 has recently been published by SP Global. Exemption under Doctrine of Sovereign. Canada charges a 15 tax on dividends held in non-taxable accounts.

However Canada has tax treaties with some countries that affect the amount of non-resident tax withheld. The amount withheld in taxes varies wildly by nation. Last reviewed - 18 June 2021.

Tax Treaties Database Global Tax Treaty Information Ibfd

Panama Tax Treaties Tax Panama

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Step By Step Document For Withholding Tax Configuration Sap Blogs

Global Corporate And Withholding Tax Rates Tax Deloitte

Step By Step Document For Withholding Tax Configuration Sap Blogs

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax In China China Briefing News

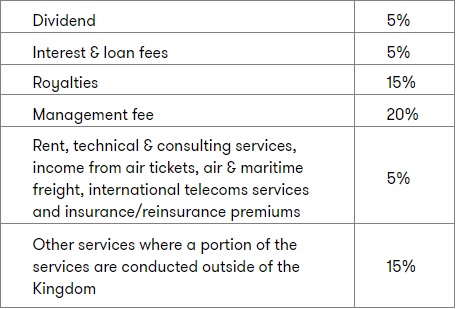

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Global Corporate And Withholding Tax Rates Tax Deloitte

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

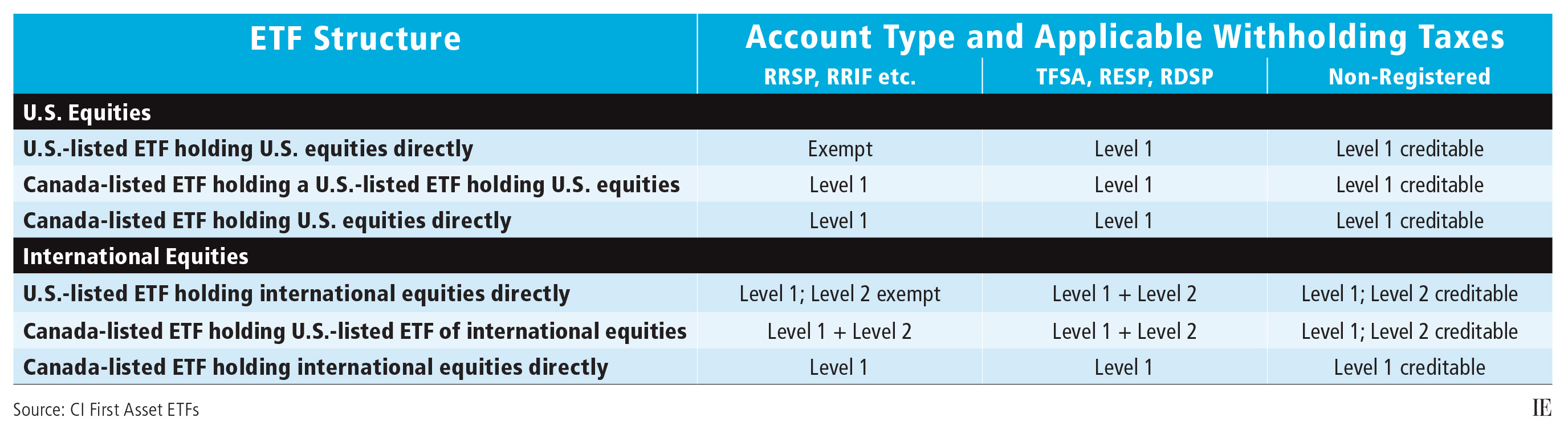

Etfs And Foreign Withholding Taxes Investment Executive

Is Dividend Withholding Tax Important In Investing Investment Moats

Step By Step Document For Withholding Tax Configuration Sap Blogs

Post a Comment for "Withholding Tax Rates Canada By Country"