Withholding Tax Rates For Professional Services

The Interest rate is increased from 5 to 7. WITHHOLDING TAX RATE TABLE - NIGERIA Companies Individuals Divident Interest Rent 10 10 Royalties 15 15 Commissions Consultancy Professional Technical Management Fees 10 5 Building Construction related activities 5 5 Contract of Supplies Agency arrangements 5 5 Director Fees 10 5.

Global Corporate And Withholding Tax Rates Tax Deloitte

Accountable persons must submit PSWT returns to Revenue and must pay us the PSWT deducted.

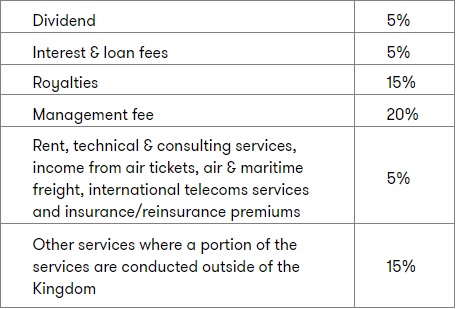

Withholding tax rates for professional services. 01-2018 and 1015 prior to this. Payments to non-tax residents are subject to withholding tax at the following rates among others. Withholding tax rates of professional fees under TRAIN RA 10963 Philippines.

Non-resident professionals are subject to 15 withholding tax on gross income. Professional fees talent fees etc. 197 rijen Withholding Tax WHT is a government requirement on the payer of an item to deduct tax.

What is exempt from Withholding Tax. PSWT is a tax that applies to payments by accountable persons for certain professional services. Agency Transactions Arrangements Agency arrangement implies a contract between a principal and agent.

Renewed treaty was signed on 24 July 2019 ratified on 5 May 2021 and pending the exchange of ratification documents. 15 10 0 but VAT 19 unless exempted. Withholding Tax also called as Retention Tax is the obligation of the taxpayer to withhold tax when making payments under specific heads such as rent commission payment for professional services salaries contracts etc at the rates that have been specified in the current tax regime.

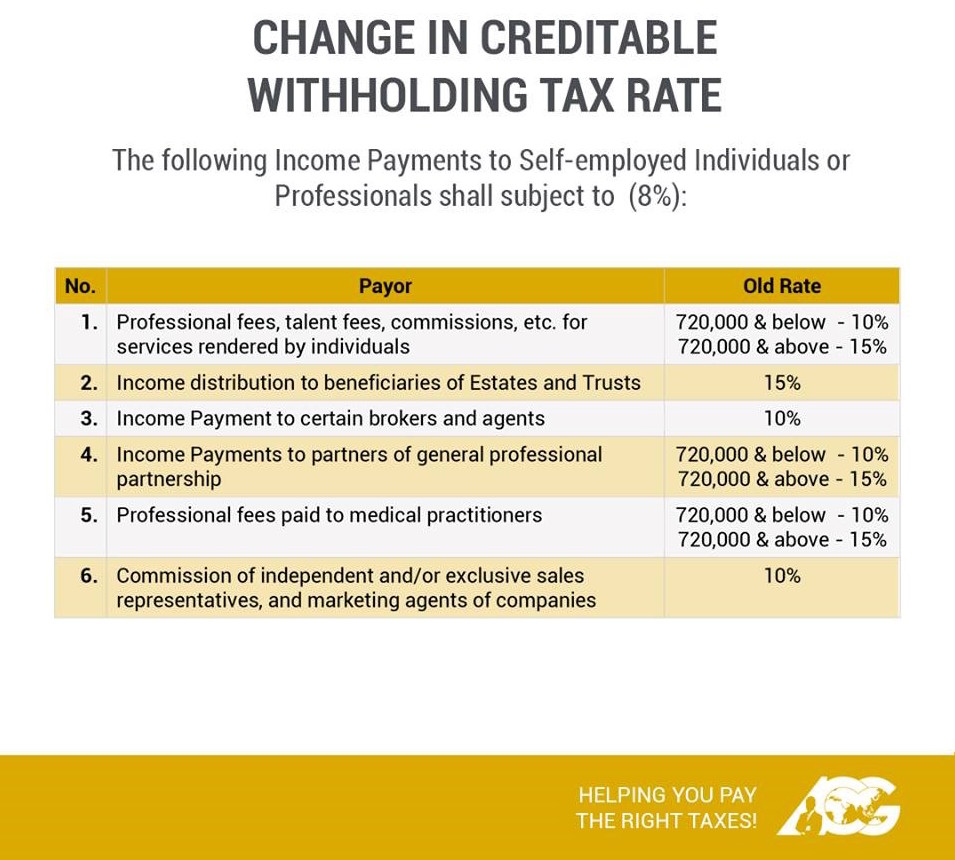

Withholding Tax on GMP - Value Added Taxes GVAT - is the tax withheld by National Government Agencies NGAs and instrumentalities including government-owned and controlled corporations GOCCs and local government units LGUs before making any payments to VAT registered taxpayerssupplierspayees on account of their purchases of goods and services. If you are an accountable person you must deduct PSWT at the rate of 20 from payments made for certain professional services. Revised withholding tax rates Type of Income Payment Old CWT Rate New CWT Rate 1.

In case of professional entertainers professional athletes and other recipient of talent fees the amount subject to withholding tax shall include amounts paid to them in consideration for the use of their names or pictures in print broadcast or other media or for public appearances for purposes of advertisements or sales proportion. 8 Withholding Tax for Self-employed and Professionals The 8 withholding tax rate replaces the two-tier rate of 10 for self-employed and professionals earning less than P720000 income every year or 15 for those earning more than P720000 per year. The reward payable for services rendered by the agent is Commission which is subject to withholding tax of 10.

For services rendered 2. A professional whose gross income during the year exceeds P720000 should be subject to 15 withholding tax. Fees received by an individual from a lone income payor amounting to not exceeding P250000 may not be subject to withholding tax.

Under RR 11-18 amending Section 2572 of RR 2-98 as amended the following are the withholding tax rates on professional fees promotional talent fees or for any other form of remuneration. They may opt to be taxed at 22 of net income instead. Professional fees paid to medical practitioners includes doctors of medicine doctors of veterinary science and dentists by hospitals and.

Otherwise if he did not meet the threshold the lower rate of 10 must be applied. Marketing commissions and residue audit fees paid to foreign agents in respect of export of flowers fruits and vegetables. The BPT rate is reduced from 15 to 10.

Professional fees talent fees and consultancy fees payable to individual payees are now subject to 510 withholding tax 8 under RMC No. 15 10 30 unless rates. Part 18-01-04Professional Services Withholding Tax PSWT - General Instructions Part 18-01-05 Administration of Professional Services Withholding Tax Part 18-01-05A ePSWT implementation guidance.

The issue of beneficial ownership has come under tax office scrutiny. Basically the applicable withholding tax rates depends on the amount of the gross income of the payee and the timing of payment of the fees. 20 percent for technical services technical assistance and consultancy either rendered in Colombia or abroad.

20 percent for personal services fees royalties lease and any other payment for the use of intellectual property. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125 or more of the voting power.

S Corp Vs C Corp Business Structure Corporate Tax Rate Accounting Services

Tax Withholding For Pensions And Social Security Sensible Money

This Quarterly Tax Reference Guide Is For Any Business That Has Employees And Contr Bookkeeping Business Small Business Bookkeeping Small Business Organization

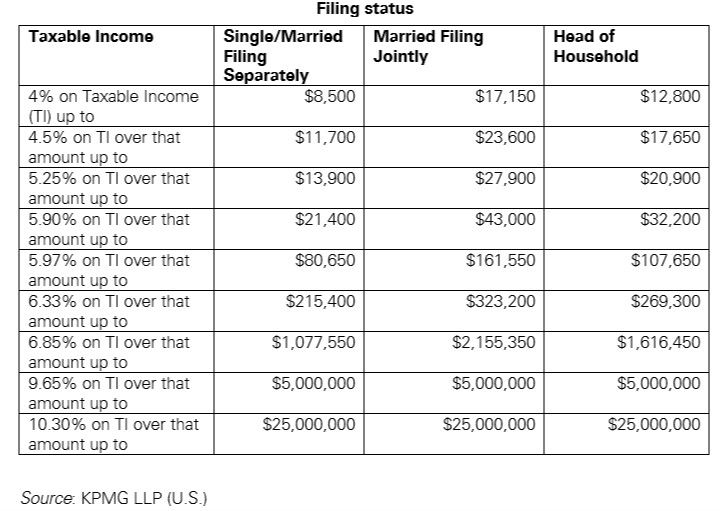

Us New York Implements New Tax Rates Kpmg Global

Doing Business In The United States Federal Tax Issues Pwc

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Tax Excellence Team Workshop On Advance Withholding Income Sales Tax Call Now For Enroll Today 02134329107 To 109 03343223 Tax Services Income Solutions

The Indian Income Tax Laws Cast An Obligation On An Employer To Withhold Taxes At The Time Of Payment Of Salaries Income Tax Tax Attorney Income Tax Return

Befiler Tax Filing Deadline Filing Taxes Tax Services Income Tax Return

Global Corporate And Withholding Tax Rates Tax Deloitte

Http Www Kcca In Services For Indian Entities Taxation Excise And Customs Starting A Business Small Scale Business Business

Brazilian Withholding Taxes Bpc Partners

A Closer Look At The 2017 Minimum Wage Hike Payroll Software Minimum Wage Solutions

Bir Withholding Tax Table 2018 Tax Table Withholding Tax Table Tax

Post a Comment for "Withholding Tax Rates For Professional Services"