Withholding Tax Rates Foreign Countries

If payment source is from initial investment Mexican REITs. Withholding tax may be refundable in terms of an investment countrys domestic tax legislation which may dictate a full or partial exemption from taxes.

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Income received from Azerbaijan sources not attributable to a PE of a non-resident in Azerbaijan is subject to WHT at the following rates.

Withholding tax rates foreign countries. Income by way of interest from Indian Company. Source income at a standard flat rate of 30. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US.

20 20 See the Withholding taxes section of. Income from foreign currency bonds or Shares of Indian company. 25 15 effective rate for Americans due to tax treaty China mainland.

8 first SRD2646 per year is deductible 38. 15 falling to zero starting in. 5 Non-Resident Withholding Tax Rates for Treaty Countries 136 Non-Resident Withholding Tax Rates for Treaty Countries Notes 1 The actual treaty should be consulted to determine if specific conditions exemptions or tax-sparing provisions apply for each type of payment.

Here is the withholding tax rate for some of the largest countries. Last reviewed - 10 February 2021. This difference is due to tax treaties between these countries and the US.

An organization may be exempt from income tax under section 501a of the Internal Revenue Code and chapter 4 withholding tax even if it was formed under foreign law. For example in developed Europe Switzerland has a very high 35 withholding tax rate for non-residents while the UK charges 0 for stocks only for Americans. Withholding Tax Rates 2021.

Companies incorporated offshore and listed on the Hong Kong Stock Exchange and exchanges in the US. 10 or 4 reduced rates Taxation in Spain Sri Lanka. Others such as Colombia Mexico Thailand etc.

19 Zeilen If a taxpayer is resident in the UK and has income andor gains in another. In most cases a foreign national is subject to federal withholding tax on US. Have a withholding tax rate of zero unless a 10 withholding tax rate is announced by the companies.

Between 1 and 20 Non-resident. Income taxes on certain income profit or. Interest paid by residents PEs of non-residents or on behalf of such PEs except for interest paid.

30 highest rate 15 lowest rate 0 15 if annual income is more than LKR 25 million 12 standard rate 8 or 0 reduced rates Taxation in Sri Lanka Sudan. A reduced rate including exemption may apply if there is a tax treaty between the foreign nationals country of. Corporate - Withholding taxes.

Claiming withholding tax based on European Court of Justice Case Law legal precedent. In most cases you do not have to withhold tax on payments of income to these foreign tax-exempt organizations unless the IRS has determined that they are foreign private foundations. Withholding tax is claimable from certain countries.

Income of Foreign Institutional Investors from securities. Income by way of interest from infrastructure debt fund. Interest paid to a foreign entity is subject to withholding tax at a tax rate of 25 percent 35 percent if paid to a resident of a black-listed country or if paid or made available in accounts in the name of 1 or more holders acting on behalf of undisclosed 3rd parties.

Dividend Withholding Tax Rates by. Certain countries afford particular groups of taxpayers investors such as pension funds or investment funds more favourable tax treatment. Income by way of interest on certain bonds and Government securities.

NA NA NA NA Taxation in Sudan Suriname. Among the high withholding tax rate countries are New Zealand Denmark Germany and Switzerland. TEF ADRs the French.

61 Zeilen For example when a US-based investor invests in France Telecom NYSE. Have a nominal tax rate of 10. Dividends paid by resident enterprises.

NA Taxation in Suriname. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. Federal Withholding Tax and Tax Treaties.

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Avoid Foreign Dividend Withholding Tax The Motley Fool

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center

Global Corporate And Withholding Tax Rates Tax Deloitte

Part I Foreign Withholding Taxes For Equity Etfs Canadian Portfolio Manager Blog

Mexico 2020 Tax Reforms White Case Llp

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

General Information On The Brazilian Tax System Bpc Partners

3 22 15 Foreign Partnership Withholding Internal Revenue Service

Pin By Jr Tax On Taxation In 2021 Tax Return Nec Form

Panama Tax Treaties Tax Panama

W 8 Ben Form Fotolia Com W 8 Ben W 8ben Instructional Design Teachers College Irs Forms

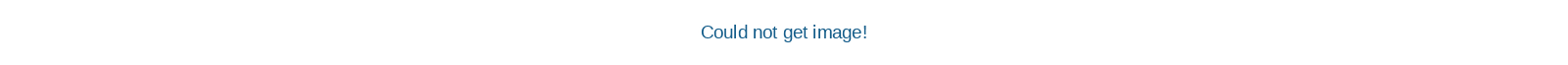

Withholding Tax In China China Briefing News

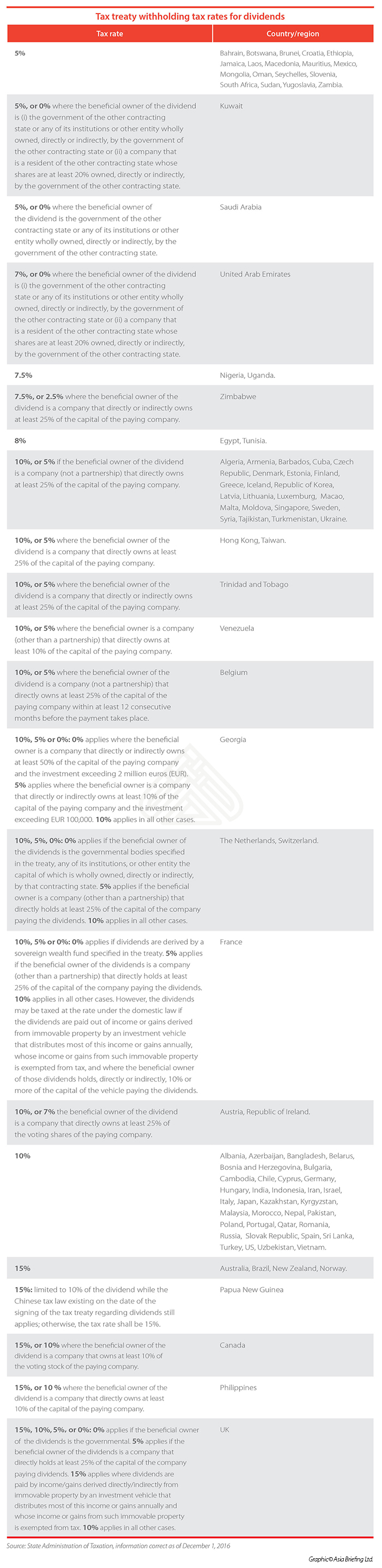

Etfs And Foreign Withholding Taxes Investment Executive

Tax Implications For Foreign Mlp Investors Nasdaq

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Post a Comment for "Withholding Tax Rates Foreign Countries"