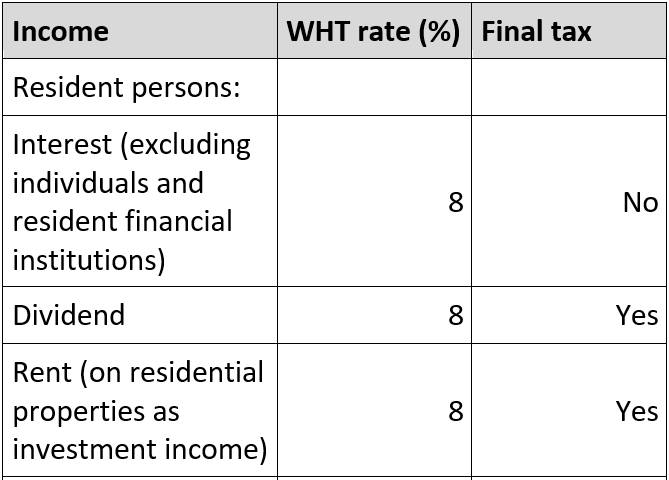

Withholding Tax Rates In Ghana 2019

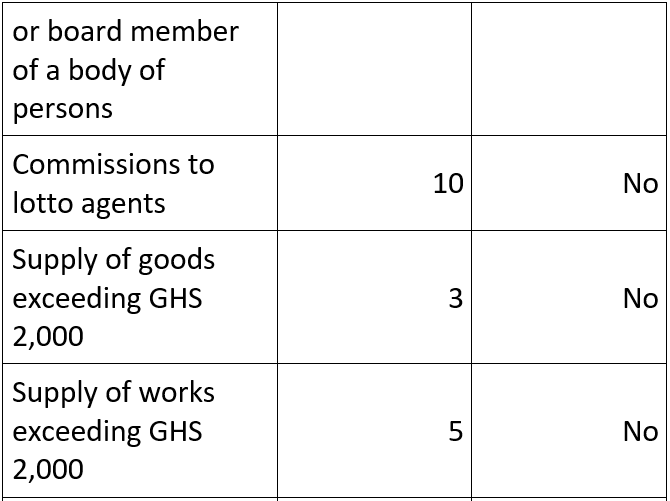

On the other hand the applicable rates for this classification of tax range between a minimum of 5 to a maximum of 15. The threshold for withholding tax in Ghana is set at GHC 2000.

22 2020 Property Tax Irs Taxes Problem And Solution

Ghana Residents Income Tax Tables in 2019.

Withholding tax rates in ghana 2019. The government of Ghana is pursuing DTTs with various countries including Nigeria Qatar Sweden Syria the United Arab Emirates and the United States. Review of personal income tax band to reduce top marginal tax from 35 on monthly taxable income above GHS10000 to 30 on monthly taxable income exceeding GHS20000. The personal income tax bands for resident individuals have been revised by the Income Tax Amendment Act 2019 Act 1007 to align the tax free income threshold to the current minimum wage of GHS 3828 per annum GHS 319 per month.

In Ghana the applicable taxes are. Over GHS 3456 up to 4656 - 5. In this interview Mr.

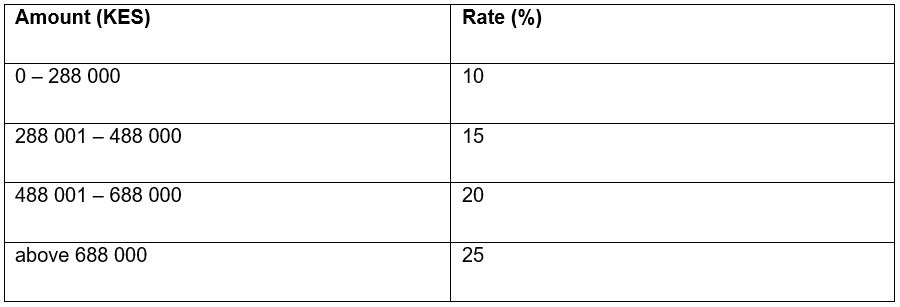

Top marginal rate of 55 for income above EUR 1 Million shall be applicable for the calendar years 2016 to 2020. Not yet in force. Married couples are assessed separately.

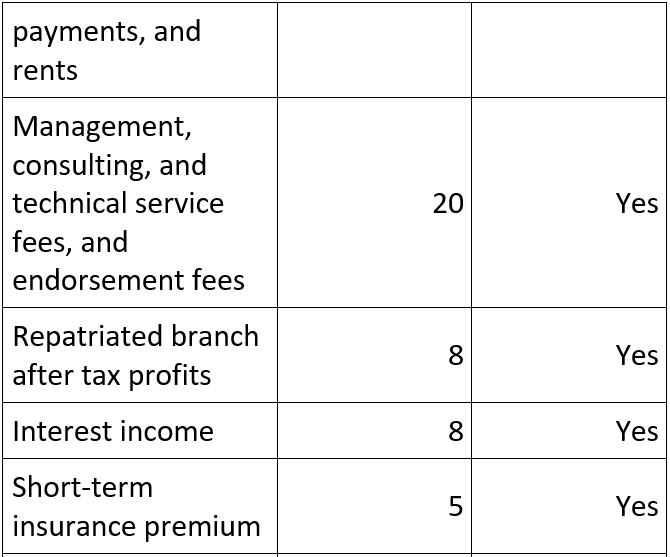

The highest marginal rate kicks in at taxable income of AWG 141783. The business and investment income of a non-resident person is included in the assessable income for a year of assessment if that income has a source in Ghana. 2 Act 2018 which includes amendments to the individual income tax brackets and rates for 2019.

David Lartey-Quarcoopome from the Training and Development Department of GRA breaks down the new levy and gives clarity on how. Individuals are considered residents of Ghana if they reside in the country for an aggregate of 183 days within a year of assessment. The New COVID-19 Health Recovery Levy Act 2021 Act 1068 The Ghana Revenue Authority implemented the New Covid 19 1 Health Recovery Levy CHRL from the 1st of May 2021.

Property rate in Ghana basically is a kind of property tax that is administered by Local Authorities. Withholding VAT agents will continue to file withholding VAT returns by the 15 th of the month. Year 2020 Chargeable income GH Rate Tax payable GH Cumulative income GH Cumulative tax GH.

Income from 633601. Income tax rates starting 1 January 2020 are 23 for monthly income. A local authority may be a metropolitan municipal or a district assembly MMDA.

1 business income 2 employment income and 3 investment income. The higher rate applies in any other case. Foreign tax credits are calculated separately for taxable foreign income from each business employment or investment and shall not exceed the average rate of Ghanaian income tax of that person for the year of assessment applied to that persons taxable foreign income for the year from each business employment or investment.

Today MMDAs derive their mandate to administer property rates from the provision in Article 2452 of the 1992 Constitution of the Republic of Ghana and subsequently from the Local Governance Act 2016 Act. Extension of tax stamp policy to include the textile industry to curb smuggling and counterfeiting within the industry. Tax Rates and Incentives.

Income from 345601. Dividend tax 25 Annual income tax rates Effective January 2020 Find below. Income from 4233601.

A payment to a casual worker is subject to 5 final withholding tax. The general corporate income tax CIT rate is 25. The Government of Ghana has passed various amendment Acts to revise the.

The VAT registered taxpayer who has made supplies and has suffered withholding VAT will continue to file both their VAT and levy returns and account for these imposts in accordance with the provision of the VAT Act 2013 Act 870 NHIL and GETFund Act respectively to the Ghana Revenue Authority. 5 for non-resident banks. The Ghana Revenue Authority has announced the passage of the Income Tax Amendment No.

Income is classified in the following categories. This is the minimum amount that attracts WHT as stipulated in the law. Payment to temporary and casual workers payment to a temporary worker is is taxed as if that worker was a permanent worker.

10 in any other case. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. 40 Zeilen Withholding Tax Rates in Ghana.

The new applicable graduated tax schedule for resident individuals is as follows. 2 Navigating taxation 2020 Ghana Tax Facts and Figures Taxation of individuals Monthly tax rates The table below indicates the new monthly income tax bands and rates generally applicable to the chargeable income of resident individuals. Corporate tax 25.

Income from 465601. Tax Data Cards 2019 11 J Withholding Tax Rates and Status Continued Payments to Residents a General Rate Status vii Rent on properties Payment to an individual Non-Business income Residential Non-Residential 8 15 Final Final viii Rent on properties Payment to persons other than an individual Business income Residential. Where a non-resident person has a Ghanaian permanent establishment PE any income connected with the PE is assessed to tax.

Taxable income is computed by. Up to GHS 3456 - 0. All companies liable for tax in Ghana are required to pay provisional tax quarterly.

Capital gains tax -15. The top marginal rate kicks in at EUR 1000000 of taxable income. Income of residents is taxed at progressive rates.

For resident individuals the rates and brackets are as follows based on annual income. The rates are however tentative and hence keep on changing from time to time.

Blog Scg Small And Medium Enterprises What I Have Learned Blog

Scg Chartered Accountant Best Chartered Accountant Services In Ghana Chartered Accountant Accounting Marketing System

Introduction Direct Tax Play A Vital Tool For Revenue Grin

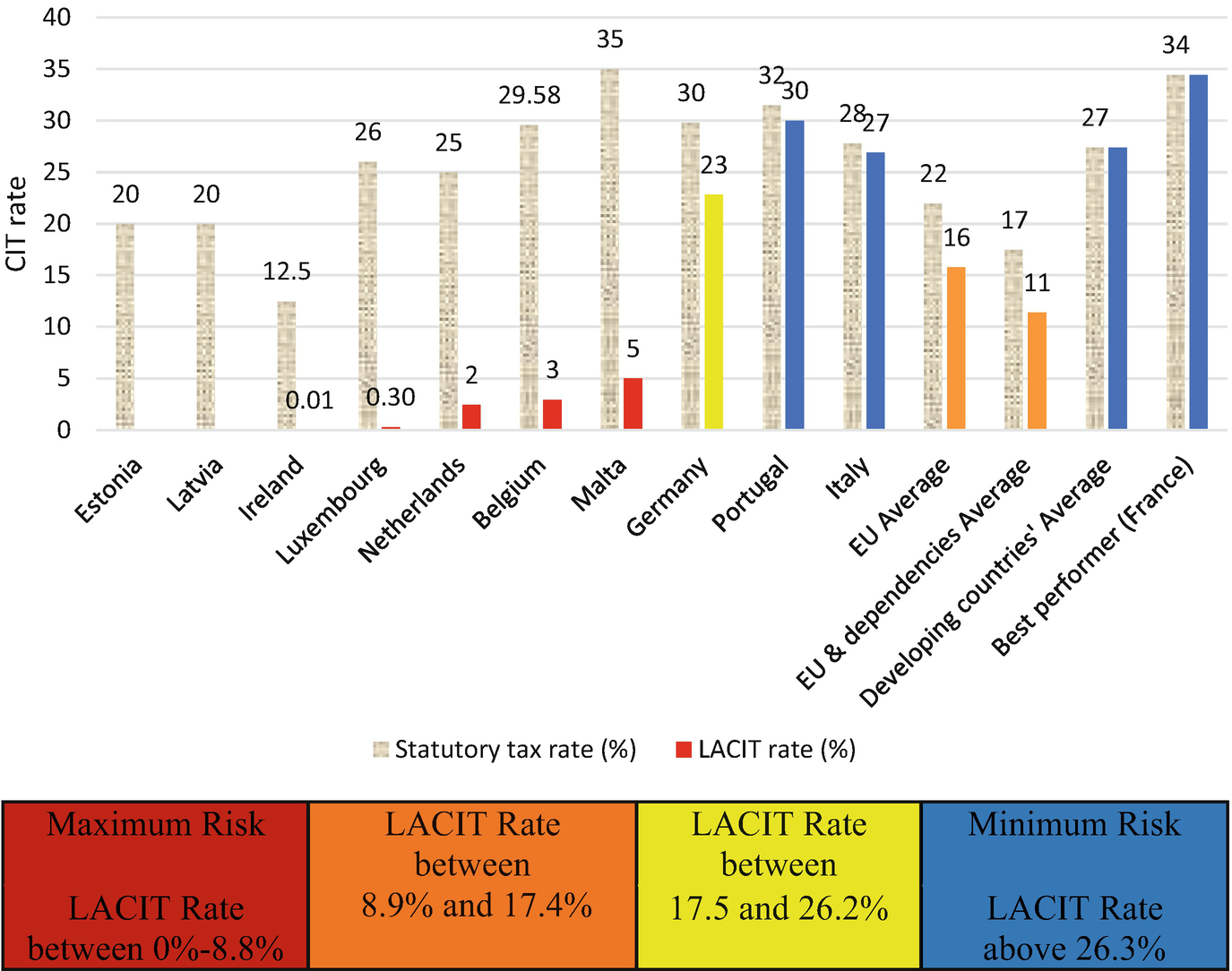

Negative Spillovers In International Corporate Taxation And The European Union Springerlink

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Tax And Financial Management Taxes Seaso Premium Photo Freepik Photo Background Business Money Text Tax Rules Financial Management Income Tax

Https Www Econstor Eu Bitstream 10419 222490 1 1724769251 Pdf

Global Corporate And Withholding Tax Rates Tax Deloitte

Https Assets Kpmg Content Dam Kpmg Xx Pdf 2020 08 Denmark Country Profile 2020 Pdf

Global Corporate And Withholding Tax Rates Tax Deloitte

Https Www Econstor Eu Bitstream 10419 222490 1 1724769251 Pdf

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Introduction Direct Tax Play A Vital Tool For Revenue Grin

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Https Www Pwc Com Gh En Assets Pdf Ghana Tax Facts And Figures 2019 Pdf

How To Avoid Double Taxation In Germany Settle In Berlin

Main Elements Of Taxation In The Conditions Of The Development Of Digital Economy

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Post a Comment for "Withholding Tax Rates In Ghana 2019"