Withholding Tax Rates On Bank Transactions 2019

The withholding tax rate will be 7 if the applicable corporate tax rate was 28 10 if the corporate tax rate was 25 or 13 if the corporate tax rate was 22 which was the standard corporate tax rate for the 2017 fiscal year and certain other prior years. 28 depending on the year.

Bir Form 2307 The What When And How

The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022 after which the 7 rate will apply again.

Withholding tax rates on bank transactions 2019. Withholding Tax Rates Applicable Withholding Tax Rates. 5 Reduction of Withholding tax on Bank Transactions from 06 to 03 from non-filers. Credit and a reduced VAT rate during 2019 and 2020.

Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART DIVIDEND IN CASH OR IN SPECIE PROFIT ON DEBT Dividend In cash or in specie. The government has proposed to delete the withholding tax rate at 03 percent for filers under Section 231A of Income Tax Ordinance 2001. It said that every banking company shall collect withholding tax from persons not on the ATL at the time of sale of such instruments.

The minister said the rate of tax to be deducted is 03 percent of the cash amount withdrawn for filers and 06 percent of the cash amount withdrawn for non-filers. Libya Last reviewed 26 May 2021 NA. Following are the rates for cash withdrawal and cash based transactions.

Httpsbitly2UCtGUu Ph03417763776 hmkashif2010 technicalinformationportal Follow me on Other Social Accounts for regular updates. For residents of Canada the rates are. In addition Mexico City provides green incentives.

Updated up to June 30 2021. The withholding tax rate shall be 06 percent under Section 231AA 1 to be collected by banking companies at the time of sale against cash of any instrument including demand draft payment order CDR STDR RTC any other instrument of bearer nature or on receipt of cash on cancellation of any of these instruments where sum total of transactions exceeds Rs 25000 in a day for persons. 10 5 in Quebec on amounts up to 5000 20 10 in Quebec on amounts over 5000 up to including 15000.

Interest Interest paid on loans obtained from. The FBR said that 06 percent withholding tax rate is applicable on non-cash banking transactions under Section 236P of Income Tax Ordinance 2001. However the non-filers will remain pay at 06 percent on cash withdrawal above Rs50000 in a day from banking system.

In the latest amendment the government abolished withholding tax on cash withdrawal for filers of income tax returns. Withholding Tax Module of Iris-Seminars Regarding. 500000 Payment to Non.

The Federal Board of Revenues FBR withholding tax collection from non-cash banking transactions fell 26 percent to Rs301 billion during the first five months of the current fiscal as annual income tax return filing increased to record high officials said on Thursday. Liechtenstein Last reviewed 24 June. 10 5 for Quebec on amounts up to and including 5000 20 10 for Quebec on amounts over 5000 up to and including 15000 30 15 for Quebec on amounts over 15000.

It is proposed that the tax on cash withdrawals by filers be eliminated. 500000 Profit on debt more than Rs. The government through Finance Act 2019 introduced 10th Schedule to the Income Tax Ordinance 2001 to enhance the rate of withholding tax by 100 percent on certain transactions.

Income Tax withheld constitutes the full and final payment of the Income Tax due from the payee on the particular income subjected to final withholding tax. Use the following lump-sum withholding rates to deduct income tax. 10 10 NA.

Interest on bank deposits are subject to 10 and apply for residents and non-residents. The measure has been taken to force persons making large transactions and paying withholding tax on such transactions but remained outside the tax net. Among other requirements taxpayers must file a request with the tax authorities by 31 March of each fiscal year.

The tax so deductedcollected shall be adjustable. 150 236 S Contract for construction assembly installation projects supervisory activities advertisement services rendered by TV Satellite Channels Profit on debt up to Rs. The rates depend on your residency and the amount you withdraw.

The financial institutions are required to collectdeduct withholding tax under Section 231 of Income Tax Ordinance 2001. There have been no changes in sections 231-A and 231-AA of the Income Tax Ordinance FBR stated. 10 10 75.

Qualifying projects involving CAPEX investment and job creation may benefit from discretionary grants provided by State and Municipal authorities. Final Withholding Tax is a kind of withholding tax which is prescribed on certain income payments and is not creditable against the income tax due of the payee on other income subject to regular rates of tax for the taxable year. 6 Updated Tax Rates for Section 231B 234 of the Income Tax Ordinance 2001 as per Finance Act 2015 - Clarification Regarding.

Aug 7 2019 Artibees 1 Comment on FBR issues withholding tax rates on cash online banking transactions Federal Board of Revenue FBR has been encouraged to decrease income tax rates for banking organisations in accordance with general corporate expense rates. Non-filers will pay a 06 withholding tax on withdrawal of cash amounting to over Rs50000 and for. A bank shall collect 06.

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Brazilian Withholding Taxes Bpc Partners

Ax 2012 Withholding Sales Tax Microsoft Dynamics Ax Community

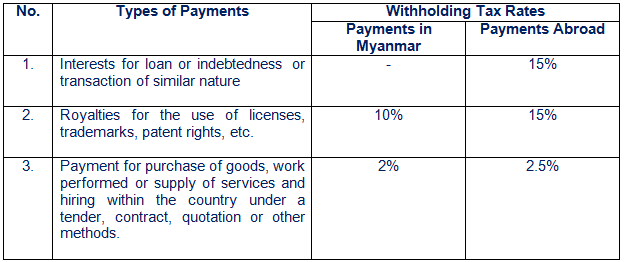

New Withholding Tax Rates In Myanmar Lawplus Ltd

Brazilian Withholding Taxes Bpc Partners

Ax 2012 Withholding Sales Tax Microsoft Dynamics Ax Community

Https Www Sap Com Mena Docs Download 2019 10 9a20c92f 6f7d 0010 87a3 C30de2ffd8ff Pdf

Tax Changes 2019 Withholding Tax Vgd

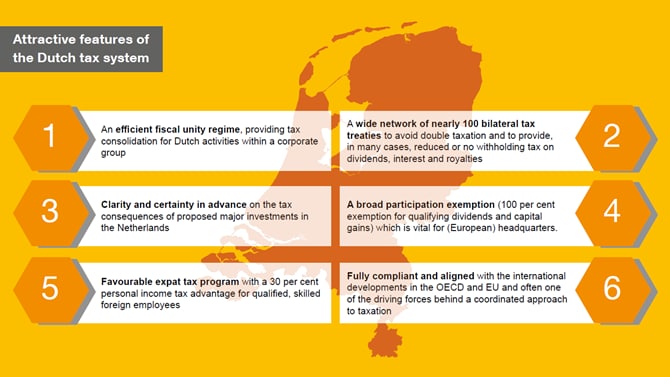

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Understanding Withholding Tax In Zimbabwe Furtherafrica

Withholding Tax Exemption Necessary But Raises Concerns The Myanmar Times

Understanding Withholding Taxes In The Philippines

Ax 2012 Withholding Sales Tax Microsoft Dynamics Ax Community

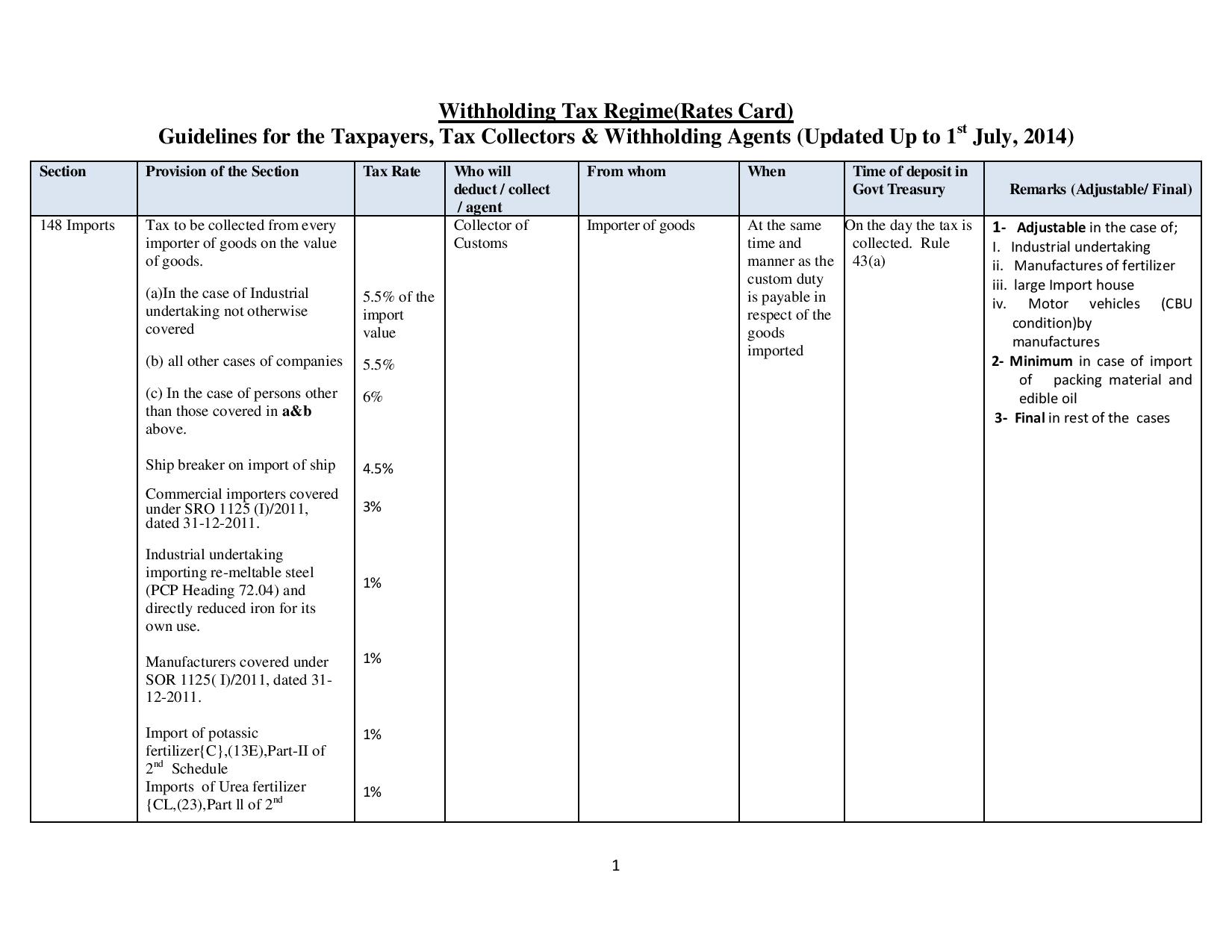

Fbr Issues Withholding Tax Rate Card For Fiscal Year 2014 2015 Customnews Pk

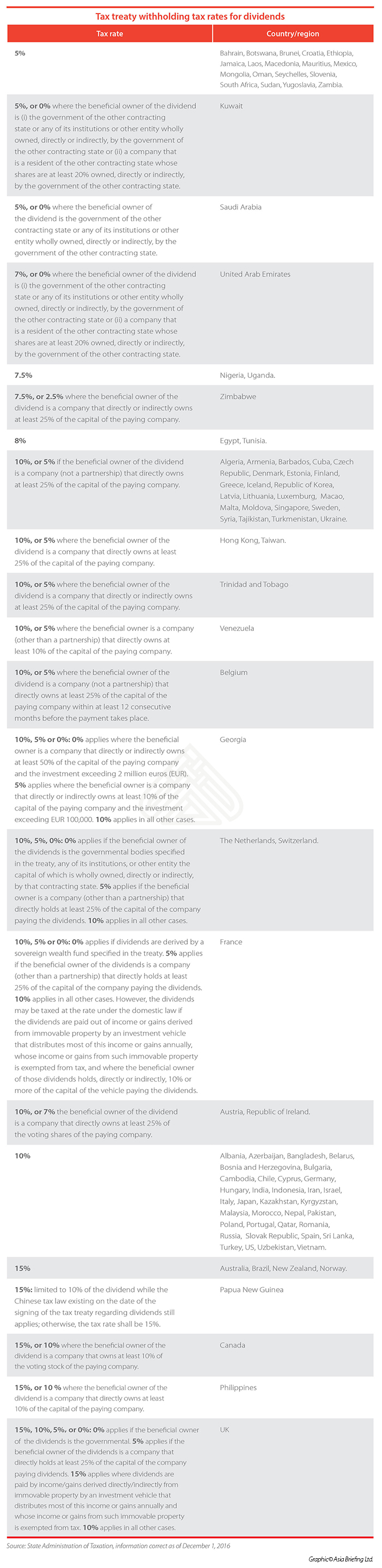

Withholding Tax In China China Briefing News

Withholding Tax Compensation How To Compute Your Taxes

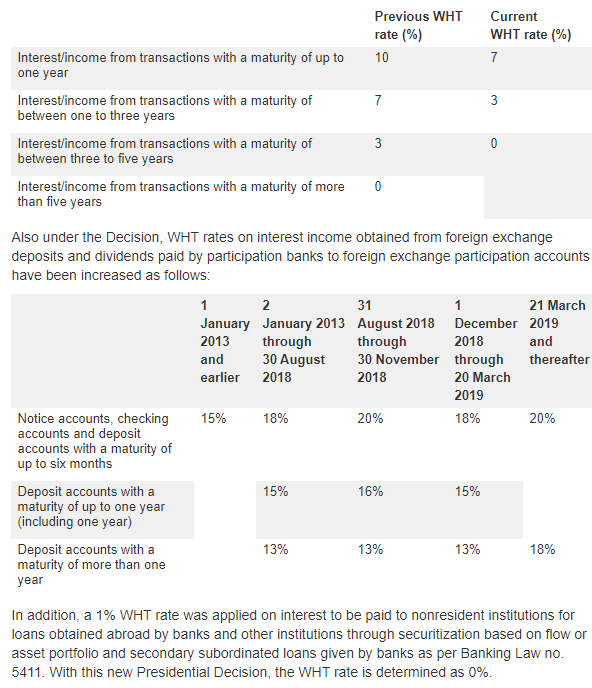

Turkey Announces Change In Withholding Tax Rates On Interest Obtained From Deposits Issued Abroad And Foreign Exchange Deposits Ey Global

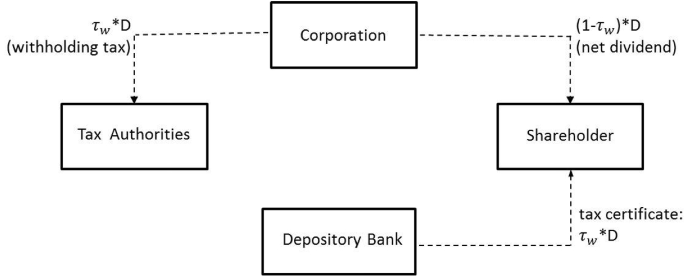

Withholding Tax Non Compliance The Case Of Cum Ex Stock Market Transactions Springerlink

Internet Consultation On Conditional Withholding Tax On Dividends Launched Pwc Tax News

Post a Comment for "Withholding Tax Rates On Bank Transactions 2019"