Withholding Tax Treaty Rates Canada

15 10 30 unless rates. See the relevant statutory provisions of the Act for specific exemptions from the withholding tax.

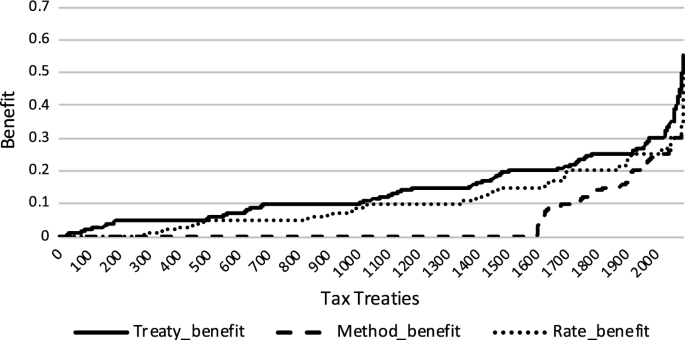

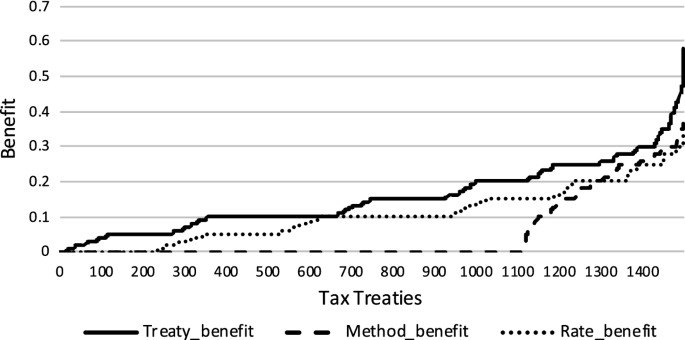

On The Relevance Of Double Tax Treaties Springerlink

Treaty or convention such as Article XXI of the Canada US tax treaty It is therefore critical that you provide RBC ITS with up-to-date information on the tax residency eligibility for reduced treaty rates of withholding and any applicable tax exemptions for all accounts owned by non-residents of Canada.

Withholding tax treaty rates canada. Non-residents have to pay a 25 tax on amounts that are taxable under Part XIII. Most of those countries are expected to become parties to the MLI and to list their tax treaty with Canada. Canada listed its tax treaties with 84 countries for the purposes of the MLI.

The following items apply. The Deloitte International Tax Source DITS is an online database featuring tax rates and information for more than 60 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions. The main purposes of tax treaties are to avoid double taxation and to prevent tax evasion.

Updated to August 1 2015 Country Interest. Withholding tax on certain interest payments to arms length. Define which taxes are covered and who is a resident and eligible to the benefits often reduce the amounts of tax to be withheld from.

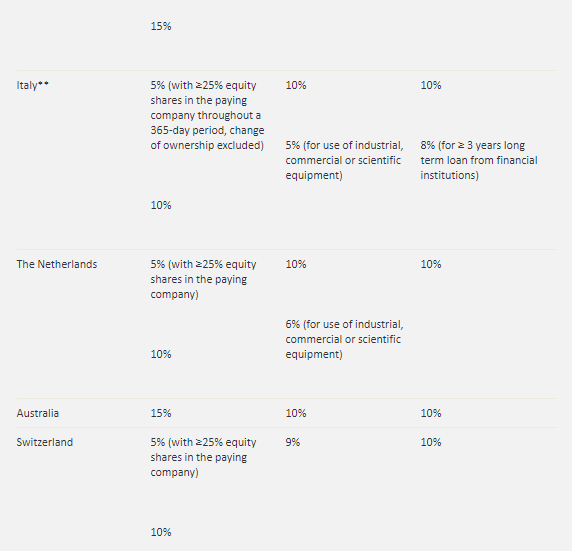

Withholding tax on dividends interest and royalties under tax treaties. 98 rijen Footnotes. Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS.

International tax treaty rates 1 1 Withholding tax rates applied by Canada to certain payments to residents of selected countries with which it has signed international tax treaties. For more information about rates of non-resident withholding tax for the various countries or regions with which Canada has tax treaties go to Non-Resident Tax Calculator see Information Circular IC76-12R6 Applicable rate of part XIII tax on amounts paid or credited to persons in countries with which Canada has a tax convention and Information Circular IC77-16R4 Non-Resident Income Tax. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

The nature of the ownership requirement the necessary percentage 10 20 25 or higher and the relevant. In the absence of a treaty Canada imposes a maximum WHT rate of 25 on dividends interest and royalties. Double taxation treaties DTTs The tables below set out the rates of WHT applicable to the most common payments of dividends interest and royalties under UK domestic law where such a liability arises and the reduced rates that may be available under an applicable DTT.

See 3 also. As a resident of Canada under the treaty you can claim a reduced withholding rate from the United States on the dividend income 15 rather than 30 and Canada generally allows you to deduct the US. Treaty or convention such as Article XXI of the Canada US tax treaty It is therefore critical that you provide RBC ITS with up-to-date information on the tax residency eligibility for reduced treaty rates of withholding and any applicable tax exemptions for all accounts owned by non-residents of Canada.

Canada has tax conventions or agreements -- commonly known as tax treaties -- with many countries. For a country listed in Appendix B D or F tax should generally be withheld at the rate of 25 unless a tax convention between Canada and that country already exists and the appropriate rate is specified in Appendix A or C. Withholding tax from your Canadian tax on that income.

15 10 0 but VAT 19 unless exempted. Canada will tax you on your worldwide income including your US. Certain exceptions modify the tax rates.

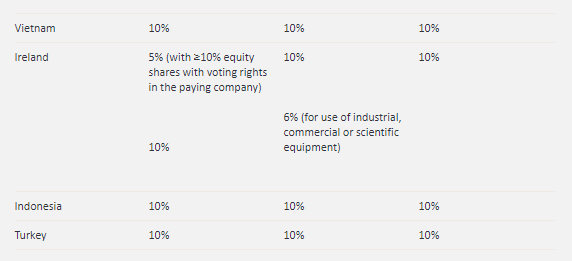

The lower lowest two for Vietnam rate applies if the beneficial owner of the dividend is a company that ownscontrols a specified interest in the paying company. It should be noted that some of Canadas tax treaties will not be covered by the MLI. Value added taxgoods and services tax.

DITS includes current rates for corporate income tax. The 5 treaty withholding tax rate on dividends applies to corporate members of FTEs that hold at least 10 of the voting shares in the company paying the dividends The treaty includes a limitation-on-benefits LOB clause that generally allows treaty benefits to be claimed only by certain qualifying persons or entities carrying on connected active business activities in both countries. As the Canadian payer or withholding agent you are responsible for withholding and remitting Part XIII tax at the correct rate.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25.

However this rate can be reduced to a lower rate or an exemption can be given under the provisions of the Income Tax Act or a bilateral tax treaty between Canada and another country.

Doing Business In The United States Federal Tax Issues Pwc

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

On The Relevance Of Double Tax Treaties Springerlink

Global Corporate And Withholding Tax Rates Tax Deloitte

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Global Corporate And Withholding Tax Rates Tax Deloitte

Pdf Taxation And Investment In Colombia

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Panama Tax Treaties Tax Panama

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

Cross Country Comparison Of Taxation In Agriculture Taxation In Agriculture Oecd Ilibrary

Tax Treaties Database Global Tax Treaty Information Ibfd

Https Www Gtn Com Hubfs Country 20tax 20guides 2019 20gtn 20canada 20tax 20overview Pdf

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Post a Comment for "Withholding Tax Treaty Rates Canada"