Annual Withholding Tax Table Train Law

How should employers withhold the tax. Another significant change specified under the TRAIN Law is the removal of additional personal.

Years after the TRAIN laws effectivity ie on or before 1 January 2023.

Annual withholding tax table train law. Screenshot from BIRs circular memorandum For Employee 1 P2397495 falls under bracket 2 compensation exceeds P2083333. The 6 tax rate likewise applies if the donee is a stranger. DONORS TAX UNDER RA 10963 OR THE TRAIN LAW CHANGE IN TAX RATE RA 10963 simplifies the donors tax schedule from an eight-bracket schedule with rates ranging from 2 to 15 to a single rate of 6 of total gifts in excess of P250OOO.

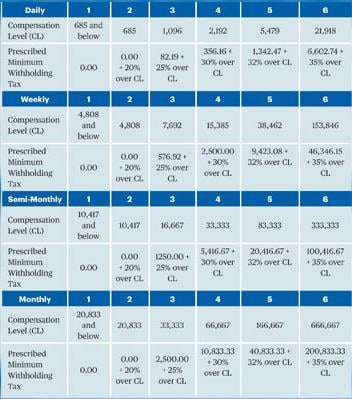

BIR issues a revised withholding tax table effective January 1 2018. The revised withholding tax table takes into consideration the new income tax rates prescribed by the Revenue Memorandum Circular issued on the 5th day of January 2018. Under the TRAIN law the compensation range that is not subject to tax has been increased to P2083300 for monthly paid employees.

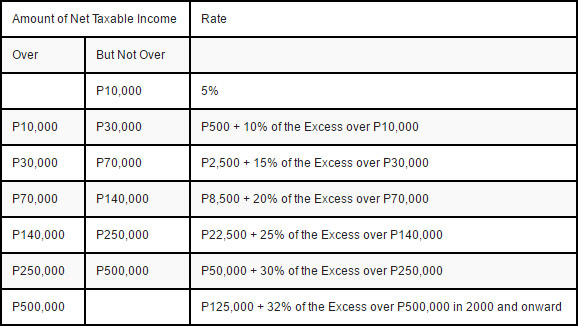

However the Bureau of Internet Revenue BIR in its Revenue Memorandum Circulars published a much specific and understandable Revised Withholding Tax Table. Withholding tax is not a tax. The computation of the income tax under the TRAIN Law is based on annual salary and corresponding annual tax rate.

Thus the withholding tax to be deducted from the employee shall be P2046384 P1083333 P3210170 x 030. 0605 and indicating MC 200 for the ATC and WE or WF for the tax type whichever is applicable. These updates discuss the new withholding tax rates withholding tax tables and how to compute withholding tax.

Withholding Tax shall be computed as follows. Philippines Tax Corporate Services 21 March 2018 Amendments to withholding tax regulations pursuant to TRAIN Law The BIR issued Revenue Regulations No. Books of accounts with gross annual sales earnings receipts or output exceeding.

Recently the BIR issued RR 8-2018 as regards computation of withholding on compensation income among others. The Bureau of Internal Revenue BIR has issued a memorandum on the revised withholding tax table. Lets understand first what we should learn from this withholding tax under train law 2018.

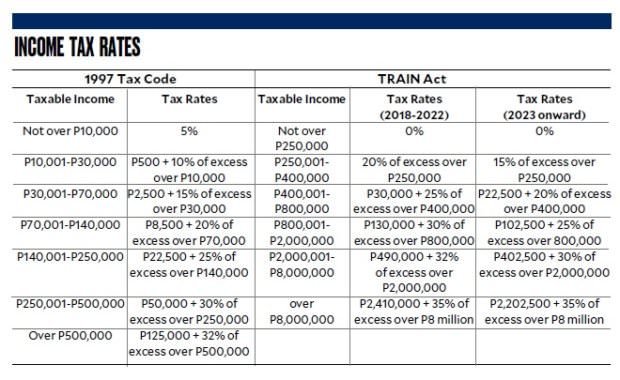

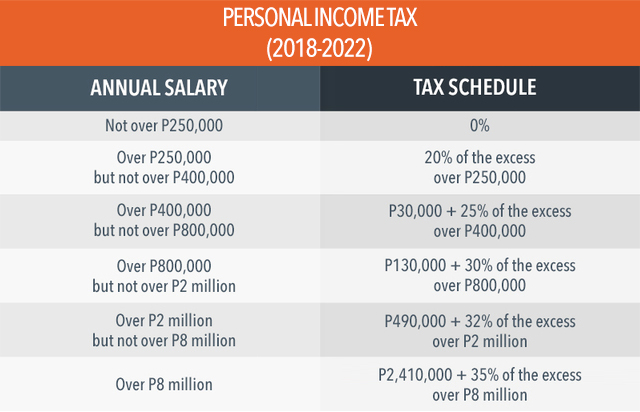

10963 or the Tax Reform for Acceleration and Inclusion TRAIN Law. The revised withholding table takes into consideration the new individual income tax rates in the TRAIN law as well as the repeal of the personal and additional exemptions for purposes of computing the individual income tax. It is effective January 1 2018 to December 31 2022.

Under the TRAIN law there will be revised rates of the individual income tax effective on January 1 2023. It is a method of collection of tax thats supposed to be paid to the government. 12 annual interest based on tax unpaid.

This excess amount of P3210170 will be multiplied by 30 tax rate and then added to a standard P1083333 as provided by the table. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. If the withholding agent fails to withhold Final Withholding Tax heshe will need to pay penalties amounting to.

25-50 surcharge based on tax unpaid. Using the above-mentioned annual tax table based on the TRAIN law you may now be able to check whether you have a tax refund or not. Once you have determined your taxable income and non-taxable income you may now look at the new annual tax table.

All companies must update their employees compensation records which has already started last January 1 2018 under the implementation of Tax Reform Law RA 10963 also known as Tax Reform for Acceleration and Inclusion TRAIN. Please refer to the illustration below for monthly. Compromise Penalty P1000 25000 every time you fail to withhold.

Before we know the updates we should know what withholding tax means. Withholding Tax Computation Under the TRAIN Law By Atty Elvin Labor Law Tax Law compensation tax withholding tax Withholding tax computation has been provided by the BIR in the RMC that it issued earlier this year. Withholding tax on income payments on supplies of goods and services respectively.

RR 11-2018 amending the provisions of RR 02-98 to implement further the provisions of Republic Act No. Withholding Agents shall remit their creditable and final withholding taxes for the first two 2 months of every quarter using BIR Fom No.

Revised Withholding Tax Table On Compensation Grant Thornton

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

How Train Affects Tax Computation When Processing Payroll Philippines

2021 Bir Train Withholding Tax Calculator Tax Tables

Old Tax Rates Will Still Apply For Personal Income In 2017 Pressreader

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

8 Optional Flat Rate Vs Graduated Tax Rates Which Is Better For Self Employed Doctors My Finance Md

Philippines Tax Updates Personal Income Tax Train Law Steemit

Everything You Need To Know About The Tax Reform Bill

Bir 1901 Form Download Form Survey Questions Survey Questionnaire

How To Use The Withholding Tax Table Effective January 1 2009 Sprout Solutions

Revised Withholding Tax Table For Compensation Tax Table Withholding Tax Table Tax

How To Use The Withholding Tax Table Effective January 1 2009 Sprout Solutions

Guide On How To Compute Tax Refund Based On Train Law Sprout Solutions

Tax Calculator Compute Your New Income Tax

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Revised Withholding Tax Table Bureau Of Internal Revenue

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

Post a Comment for "Annual Withholding Tax Table Train Law"