Employment Tax Rates Louisiana

Tax rate of 6 on taxable income over 50000. 2021 Louisiana State Sales Tax Rates The list below details the localities in Louisiana with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

The Stunning Success Of The Uk Labor Market Lowering Wages Increases Employment Labour Market Employment Aggregate Demand

They refer to it as the Unemployment Insurance Contribution Rate UI.

Employment tax rates louisiana. A new employer who must serve the required eligibility period in. 231553 allows these Social Charges to be assessed. You can find Louisianas tax rates here.

Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. Tax rate of 4 on taxable income between 12501 and 50000. Wage Base and Tax Rates.

The state UI tax rate for new employers is subject to change from one year to the next. The state charges a progressive income tax meaning the more money your employees make the higher the income tax. Louisianas unemployment tax rates for experienced employers generally are to decrease in 2020 a spokeswoman for the state Workforce Commission said Dec.

Local Taxes There are no local income taxes imposed in Louisiana. Of Louisiana Income Tax Withheld On or before February 28 of the following year. Effective for 2020 tax rates are to range from 009 to 196 for positive-rated employers and from 2 to 62 for negative-rated employers the spokeswoman told Bloomberg Tax in an email.

There are a total of fifteen states with higher marginal corporate income tax rates then Louisiana. Louisiana new employer rate range from. Non-Charge Social Charge Incumbent.

Louisiana collects a state corporate income tax at a maximum marginal tax rate of 8000 spread across five tax brackets. In Louisiana different tax brackets are applicable to different filing types. Employees complete Form L-4 Employees Withholding Exemption Certificate used for calculating withholdings.

UI tax is paid on each employees wages up to a maximum annual amount. The tax rate ranges from 2 on the low end to 6 on the high end. That amount known as the taxable wage base has been stable at 7700 in Louisiana for many years.

For married taxpayers living and working in the state of Louisiana. Tax rate of 2 on the first 25000 of taxable income. Louisiana does not have any local city taxes so all of your employees will pay only the state income tax.

Tax rate of 2 on the first 12500 of taxable income. Each employer who withholds from the combined wages of all employees 5000 per month or more must pay on a semimonthly basis. Taxes in Louisiana Income tax.

200 - 600 Sales tax. Each marginal rate only applies to earnings within the applicable marginal tax bracket. 445 - 1145 Property tax.

Existing employers pay between 006 and 79. Automatically mailed to newly registered employers for withholding taxes or on our website at wwwrevenuelouisianagov R-1300 L-4 Employees Withholding Exemption Certificate An employee is required to submit this certificate to his employer on or before. Louisiana Unemployment Insurance Tax Rates LA Employment Security Law RS.

Louisiana requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. 116 to 289 based upon industry and rates classification for 2021 Louisiana State Disability Insurance SDI. Louisiana has three marginal tax brackets ranging from 2 the lowest Louisiana tax bracket to 6 the highest Louisiana tax bracket.

Louisiana does not have any reciprocal agreements with other states. However its always possible the amount could change. 053 average effective rate Gas tax.

Each employer who withholds from the combined wages of all employees at least 500 but less than 5000 per month is required to pay on a monthly basis. 20 cents per gallon of regular gasoline and diesel. For single taxpayers living and working in the state of Louisiana.

New employers pay 313 in SUTA for employees making more than 11100 per year. Louisianas unemployment tax rates for experienced employers are to range from 01 percent to 62 percent in 2019 A reduction of 10 percent is to apply to the base tax rates The rates include social charge assessments and a reduction of 10 percent applied to the base tax rates. How Your Louisiana Paycheck Works.

732 rows Tax Examiners and Collectors and Revenue Agents. Employers with few unemployment claims may pay nearly 10 times less than those with high unemployment claims. No matter which state you call home your employer withholds money for FICA taxes which include Social Security and Medicare taxes.

San Diego Tax Attorneys To Assist Clients In Filing Irs Offers In Compromise Kuam Com Kuam News On Air Online On Demand Tax Attorney Tax Lawyer Offer In Compromise

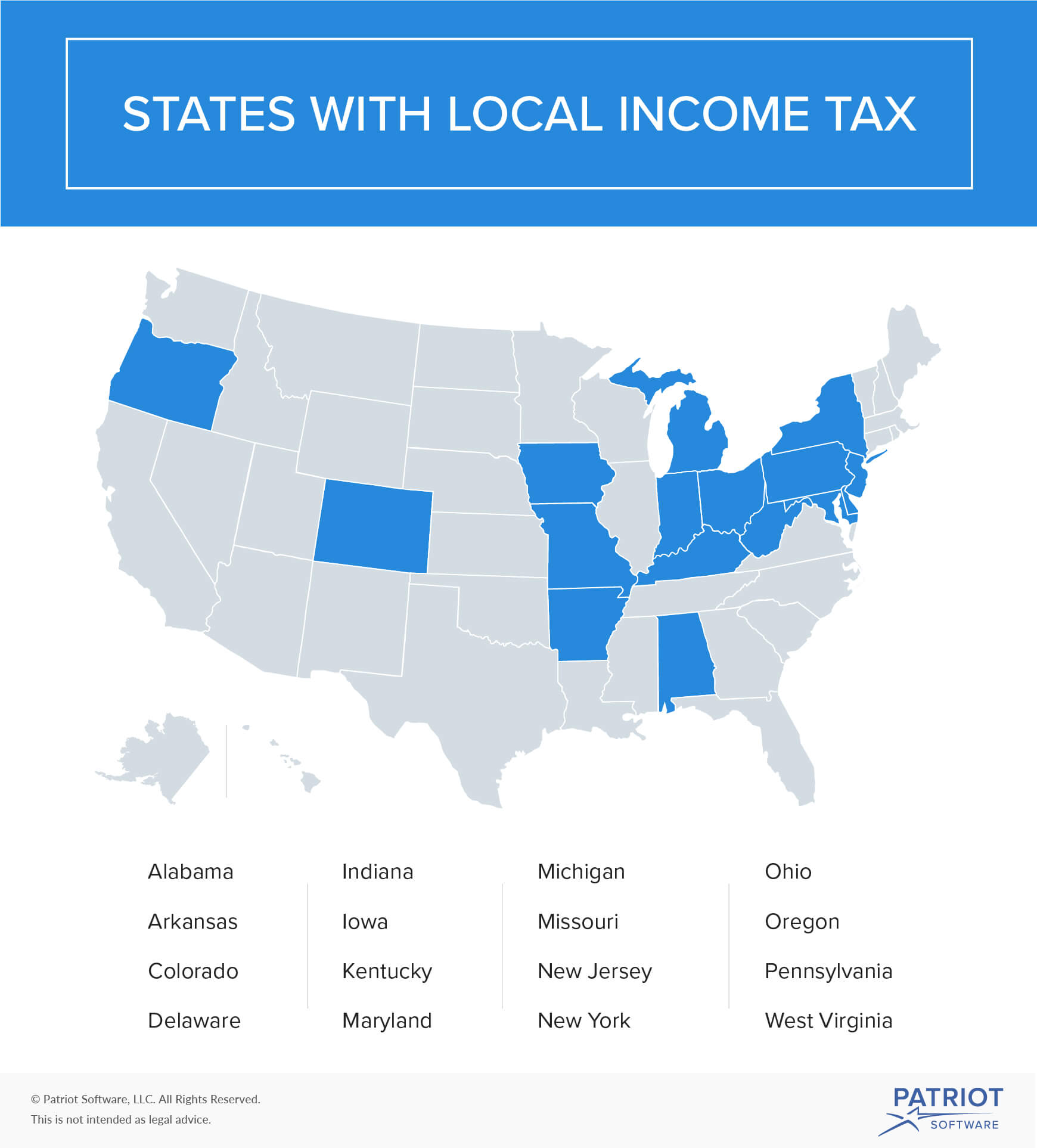

What Is Local Income Tax Types States With Local Income Tax More

How To Open A Bank Account In Singapore Paul Hype Page Co Opening A Bank Account Accounting Bank Account

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template Memories List Template Joggers

States With Highest And Lowest Sales Tax Rates

Big Tech In Healthcare Here S Who Wins And Loses As Alphabet Amazon Apple And Microsoft Home In On Niche Sectors Of Blog Planning Digital Health Life Science

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Business Tax

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

2021 Federal State Payroll Tax Rates For Employers

Are Health Insurance Premiums Tax Deductible Insurance Deductible Best Health Insurance Buy Health Insurance

Jaime Jones Named Sprint Area President South Infographic Statistics Central Texas Mississippi Arkansas

Life Sustaining Statute Louisiana Legal Forms Reconciliation Invoice Template Word

Visualizing Household Income Distribution In The U S By State Each State In The U S Is Unique With Different Economic Pros Household Income Income Oil Jobs

Pin On Newbie Internet Marketing

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

Post a Comment for "Employment Tax Rates Louisiana"