Hmrc Update Self Employment Details

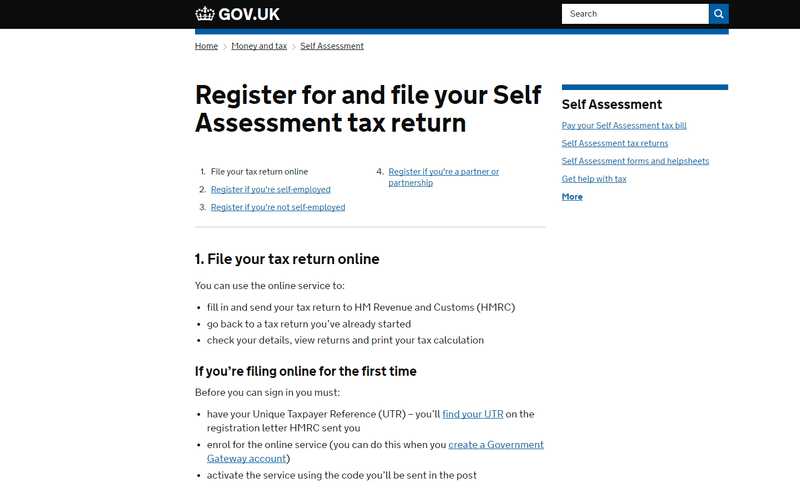

HMRC shares new fifth SEISS grant details including when you can claim payment dates and eligibility Claims for the fifth Self-Employment Income. To work out your eligibility for the fifth grant HMRC will look at your 2019-20 self-assessment tax return.

Ir35 Tax Relief On Travel And Subsistence Limited Company Naming Your Business Tax Return

The rules on who is.

Hmrc update self employment details. Once youve registered you can sign in for things like your personal or business tax account Self Assessment Corporation Tax PAYE for employers and VAT. Clarifications on the calculation of self-employed. Twitter Facebook LinkedIn Email Copy HMRC has published further guidance on the Self-Employed Income Support Scheme SEISS including how to calculate trading profits.

If youre self-employed or a member of a partnership and have been impacted by coronavirus COVID-19 find out if you can use this scheme to claim a grant. The service is now closed for the Self-Employment. This page has been updated with the information for the third grant of the Self Employed Income Support Scheme.

How you contact HM Revenue and Customs HMRC to update your name or address depends on your situation. Other ways to update your details If youre self-employed or in a partnership you can write to the address on the most recent correspondence you have from HMRC or call the Income Tax helpline. HMRC updates guidance for self-employed coronavirus scheme.

Find out by adding your postcode or visit InYourArea Self Assessment tax returns which are usually completed by self-employed workers are due in various stages throughout the year. HMRC took to social media to warn Britons of the potential for. HMRC have updated their guidance around the Self-employed Income support Scheme.

HMRC issues update on self-employment grant 5 as three step criteria announced SEISS has undergone a major update today as HMRC has provided further details regarding the fifth and final. Business Details MTD API v10 Beta Register Sign in Overview. Youll also need to change your business records if you run a business.

HMRC has published further guidance on the SEISS including details of how to work out total income and. HMRC update guidance for self-employed. However HMRC has also issued a warning reminding UK.

This version is in beta - expect some breaking changes. Applications now open HMRC says applications are now open for the third SEISS grant to support self-employed people affected by coronavirus Covid-19. Your trading profits must be no more than 50000 and.

For those completing an online return this must be completed by January 31 2022. SELF-EMPLOYED workers are being reminded to apply for the fifth SIESS grant through the coronavirus Covid-19 support scheme before September 1. You also need the dummy business for submitting Annual Summaries.

Business Details MTD API. Retrieve self employment business details api - this is where youd get your businessId. The tax authority has published a number of examples that show when a business has been adversely affected and meets the criteria for the first and second grants.

Hmrc-api-team mentioned this issue Aug 11 2021. Paper based tax returns must be completed by midnight on October 31 2021. Self-Employment Income Support Scheme SEISS third grant.

Detail of the treatment of losses averaging and multiple trades. HMRCs 30 November update focusses on the third Self-Employment Income Support Scheme SEISS claim processes and details of SEISS webinars. 404 when submitting self-employment.

This guide is also. HMRC also said that 34m self-employed individuals were identified as potentially eligible for the fourth SEISS grant - which closed for applications on June 1 - but that only 2m 58 of that. Sign in to HMRC online services.

Create a self-employment periodic update sa api - Using the start date for your dummy business created in step 3. HMRC has updated its guidance regarding the eligibility of businesses for the two Self-employment Income Support Scheme SEISS grants. Let us know if you have any issues.

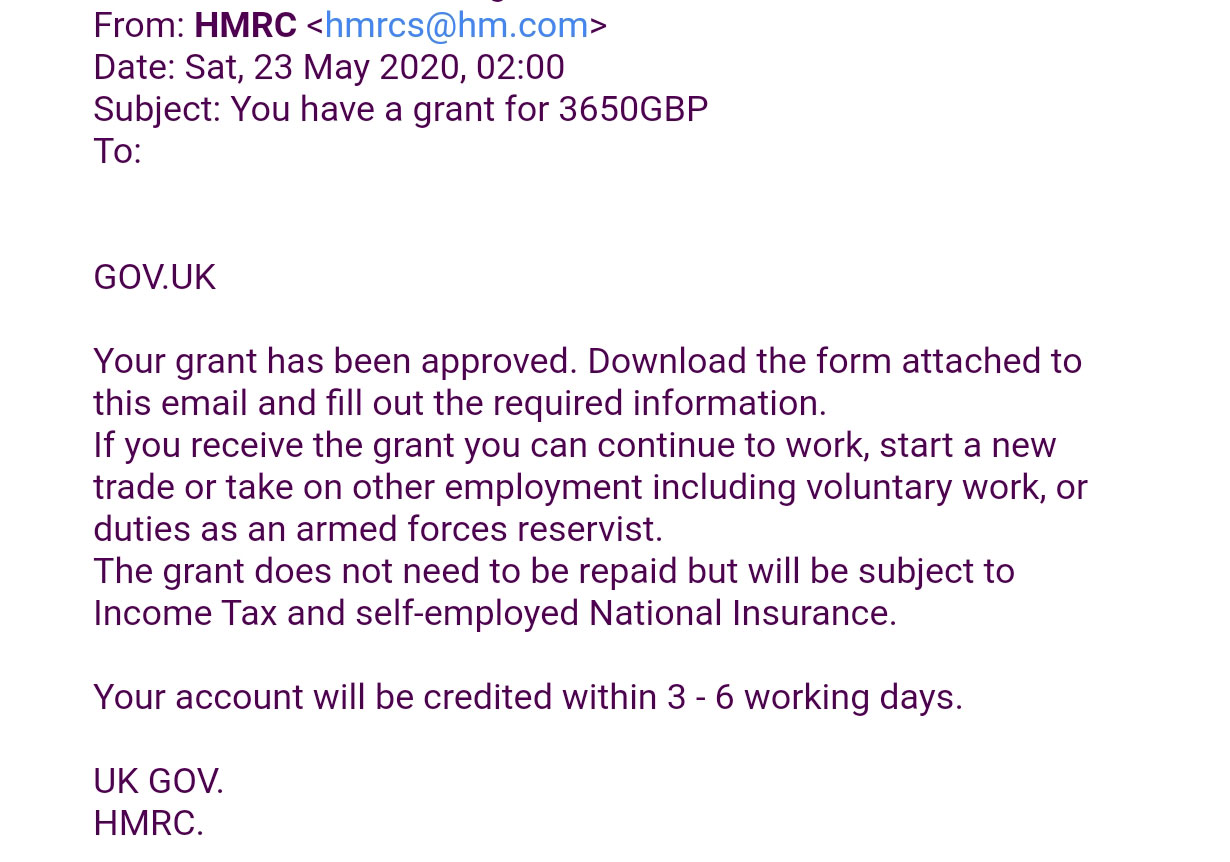

Select version and status View. The consequences could leave self-employed people in an even more challenging financial situation so it is important to stay alert. HMRC updates self-employed rescue package details.

Martin Lewis outlines details on the fifth SEISS grant SEISS or the Self-Employment Income Support Scheme as it is formally known offers individuals the.

Your Self Employed Tax Return Youtube

Seiss Grants When You Can Apply For Financial Help As Applications Reopen Coventrylive

Check If You Can Claim A Grant Through The Self Employment Income Support Scheme Newton Abbot Exeter Peplows

Self Assessment General Enquiries Contact Hm Revenue Customs Gov Uk Self Assessment Assessment Self

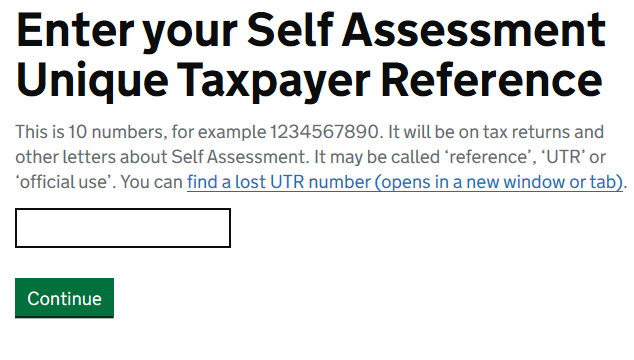

How To Register As Self Employed Uk Startups Co Uk

How To View And Download Your Tax Documents

How To Register As Self Employed Uk Startups Co Uk

Self Employment Income Support Scheme Supporting Your Clients With Their Claim For The Fifth Grant Youtube

2 000 Submitted Tax Returns To Hmrc On Christmas Day In 2019

How To Register As Self Employed In The Uk A Simple Guide

Hmrc Fake Grant Scam Tax Mail Claims Self Employment Grant Has Been Approved

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Income

Seiss Grant Hmrc Warning To Self Employed Claiming Latest Support During Pandemic Nottinghamshire Live

Infographic Tax Returns Are You Ready For The 31st January Deadline Easy Accountancy Accountants For Freelancers Sole Trade Tax Return Sole Trader Tax

How To Complete A Self Assessment Tax Return With Pictures

How To View And Download Your Tax Documents

How To View And Download Your Tax Documents

Segment Of Financial Law That Defines How Citizens Will Be Charged Taxes And Other Obligations To It Relacionada Tax Software Income Tax Return Tax Preparation

Post a Comment for "Hmrc Update Self Employment Details"