What Is The Percentage Of Withholding Tax In Ghana

The Ghana Revenue Authority GRA would this year start charging seven percent VAT Withholding Tax on individuals and entities that transact business with the Ministries Departments and. The Web site of the Ghana Revenue Authority.

Tax Coordination Tax Competition And Revenue Mobilization In The West African Economic And Monetary Union In Imf Working Papers Volume 2013 Issue 163 2013

The Ghana Revenue Authority GRA would this year start charging seven per cent VAT Withholding Tax on individuals and entities that transact business with the Ministries Departments and Agencies MDAs.

What is the percentage of withholding tax in ghana. 5 for non-resident banks. A withholding agent who fails to withhold the tax shall be liable to pay the tax. Residents are subject to tax at rates ranging between 0 and 30 on the following annual graduated scale of income.

Percentage General Corporate Tax. Income Tax Regulation 2016 LI. You must have money withheld from your paycheck each pay period to pay your tax obligation or pay quarterly taxes if self-employed.

On the other hand the applicable rates for this classification of tax range between a minimum of 5 to a maximum of 15. The 25 percent National Health Levy is now combined with the Education Trust Fund Levy of 25 percent. Not yet in force.

2 Exchange rate used. The general withholding tax rates for payments for contracts for the supply or use of goods supply of works and for the supply of any services involving one resident person to another resident person ranges from 3 to 75 and is on account of tax liability. A withholding agent is entitled to recover the tax.

It is further assumed that the employee is provided with accommodation which will be quantified at 10. The National Pensions Act 2008 Act 766 National Pensions Amendment Act 2014 Act 883 Guidelines for the Registration of Expatriate Foreign Workers issued by the National. This total cash emolument will be denoted as TCE1.

The rates are however tentative and hence keep on changing from time to time. This is the minimum amount that attracts WHT as stipulated in the law. Withholding VAT Scheme VAT Withholding Agents are required to continue to withhold VAT at a rate of 7 on the taxable value for VAT Sales Value NHIL GETFL on all standard rated supplies.

Tax is withheld at source and it is a final tax. Non-residents pay taxes at the flat rate of 25. 10 of GHS5000 results in GHS500.

Companies Producing Cocoa By-Products. The table below indicates the new monthly income tax bands and rates generally applicable to the chargeable income of resident individuals. Corporate - Tax credits and incentives.

Companies Listed on the GSE. The VAT Withholding Agent shall issue the suppliers with withholding VAT certicate showing the amount of VAT withheld. Companies Engaged in Non-Traditional Exports.

Extension of tax stamp policy to include the textile industry to curb smuggling and counterfeiting within the industry. Gross rental income earned by nonresident individuals from leasing nonresidential properties is taxed at a flat rate of 15 withheld at source. The chargeable income of non-resident individuals is generally taxed at a flat rate of 25.

The threshold for withholding tax in Ghana is set at GHC 2000. The standard VAT rate is 125 percent. 25 after 1 for the 1 St 5 years Venture Capital Financing Company.

What is withholding tax in ghana The Internal Revenue Service operates a pay-as-you-go tax system. Branch profits repatriation final non-resident. 8 After 10 year Tax Holiday Manufacturing Companies.

Ghana split the 25 percent National Health Levy from the combined current VAT rate. The chargeable income of non-resident individuals is generally taxed at a flat rate of 20. That means the new qualifying employment income of the employee is GHS5500 and this is also the new total cash emolument.

The government of Ghana is pursuing DTTs with various countries including Nigeria Qatar Sweden Syria the United Arab Emirates and the United States. The information contained in this publication is based on the Ghana Income Tax Act 2015 Act 896 and subsequent amendments. Corporate - Tax administration.

A withholding agent shall file and pay to the Commissioner-General within fifteen 15 days after the end of the month a statement in the prescribed form and tax withheld. 10 in any other case. This new amount is denoted TCE2.

Review of personal income tax band to reduce top marginal tax from 35 on monthly taxable income above GHS10000 to 30 on monthly taxable income exceeding GHS20000. The rate was restructured from the previous 15 percent to 125 percent in August 2018. 100 US 400 GHS 3 Gross rental income earned by nonresident invidiuals from leasing residential properties is taxed at a flat rate of 8 withheld at source.

40 rows Withholding Tax Rates in Ghana.

Advocate Tax Solutions Llc Ats Is A Full Service Tax Defense Firm Engaged In Practice Before The Internal Reven State Tax Solutions Internal Revenue Service

147 Killed By Road Crashes In The Northern Region Northern Region Monster Trucks Region

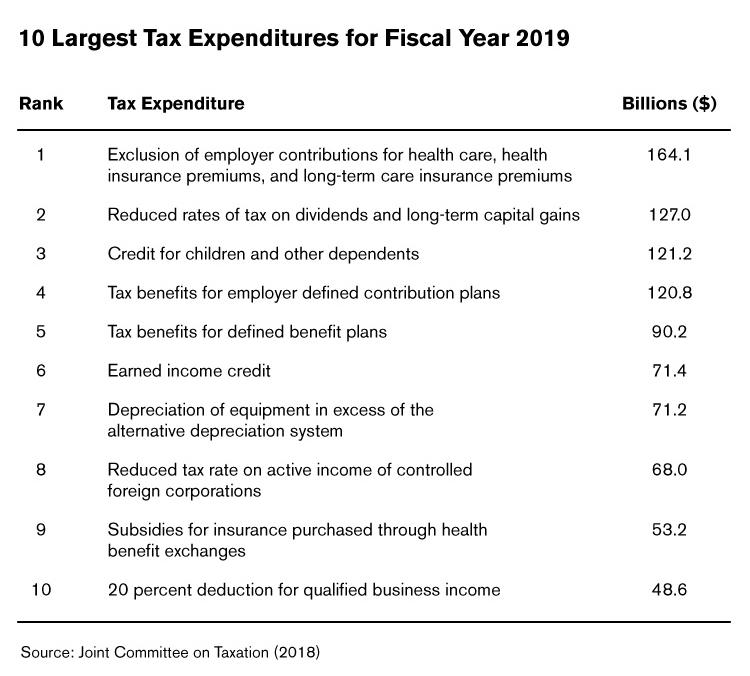

What Are Tax Expenditures And Loopholes

Youtube Will Now Be Withholding Your Taxes Centurion Law Group

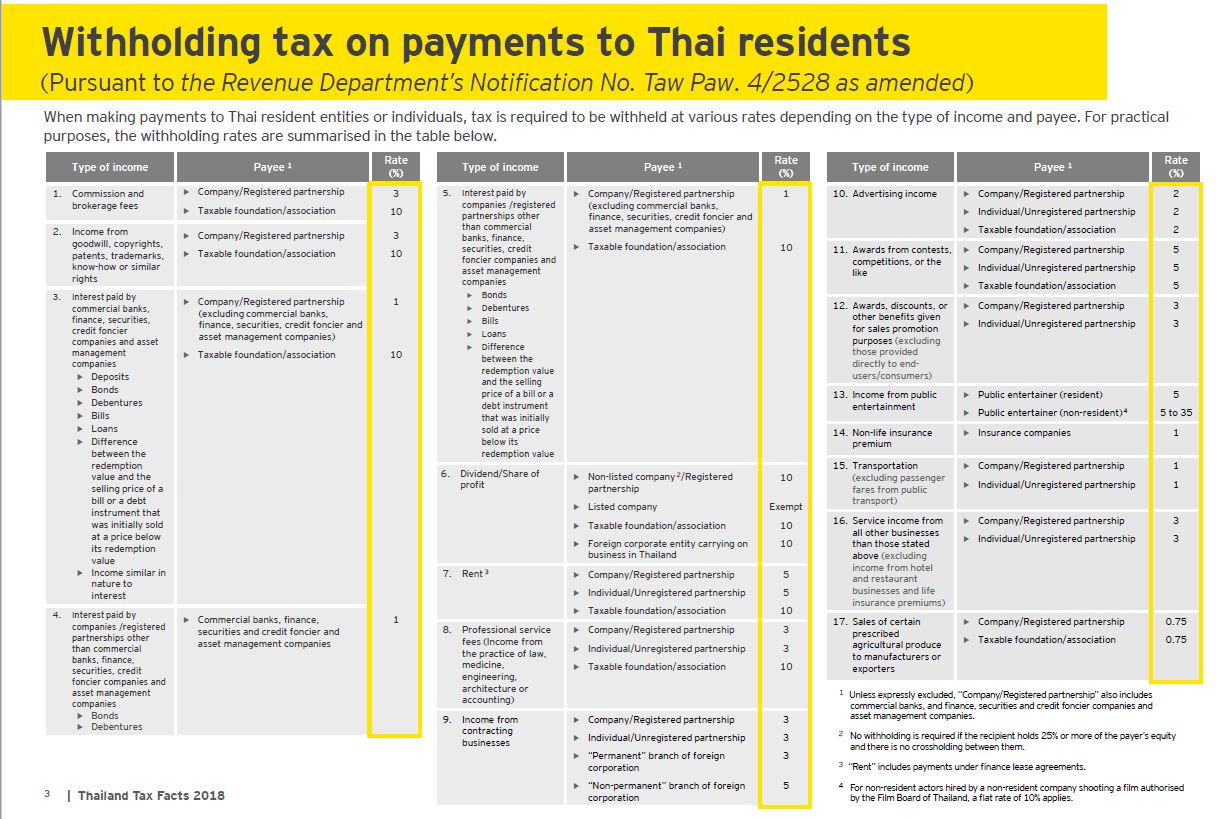

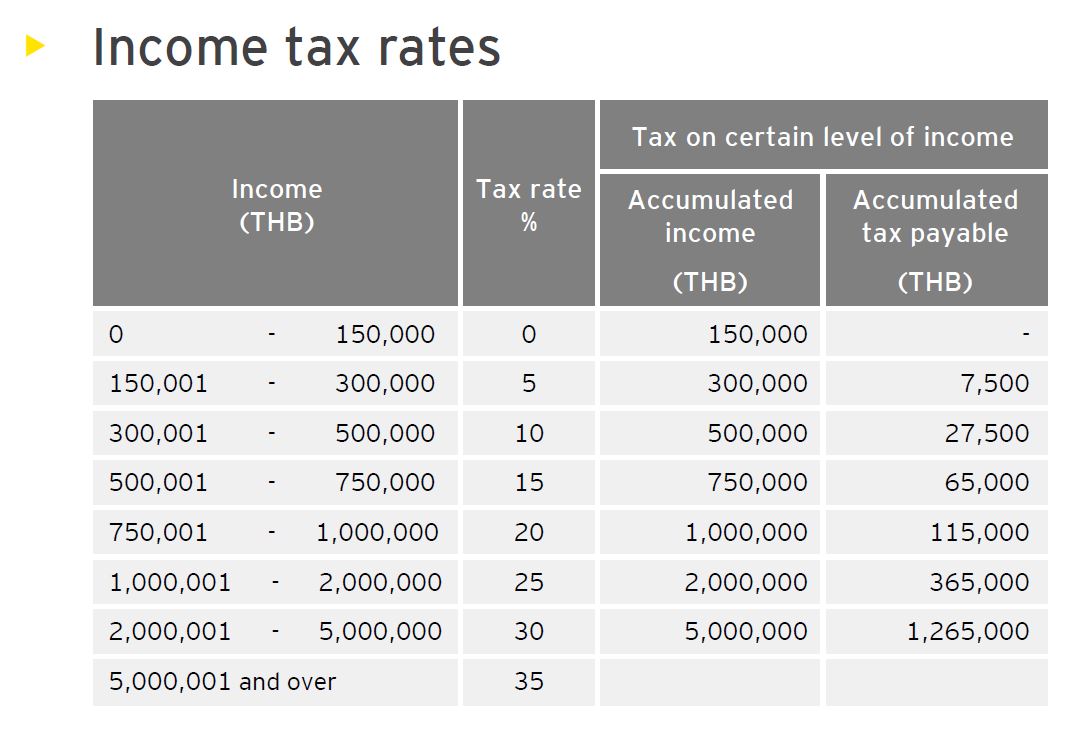

Real Estate Taxation In Thailand Thai Property Group

Main Elements Of Taxation In The Conditions Of The Development Of Digital Economy

Real Estate Taxation In Thailand Thai Property Group

Https Www2 Deloitte Com Content Dam Deloitte Global Documents Tax Dttl Tax Survey Of Global Investment And Innovation Incentives Ghana 2020 Pdf

Https Assets Kpmg Content Dam Kpmg Xx Pdf 2020 08 Denmark Country Profile 2020 Pdf

Advocate Tax Solutions Llc Ats Is A Full Service Tax Defense Firm Engaged In Practice Before The Internal Reven State Tax Solutions Internal Revenue Service

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Ghana S Mobile Money Agent Tax Rise Passed To Consumers Developing Telecoms

22 2020 Property Tax Irs Taxes Problem And Solution

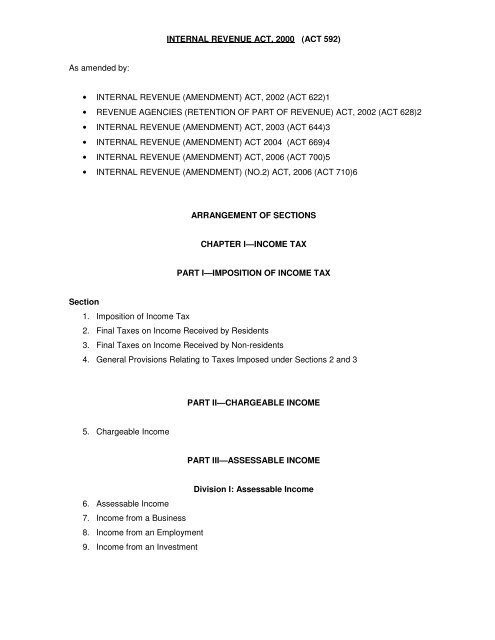

Act 592 Ghana Revenue Authority

Corporation Income Tax Structure In Developing Countries In Imf Staff Papers Volume 1977 Issue 003 1977

Maldives Introduction Of A Comprehensive Income Tax Regime In Maldives Commonwealth Association Of Tax Administrators

Germany Taxing Wages 2021 Oecd Ilibrary

Corporation Income Tax Structure In Developing Countries In Imf Staff Papers Volume 1977 Issue 003 1977

Post a Comment for "What Is The Percentage Of Withholding Tax In Ghana"