Withholding Tax Rate Malaysia Dta

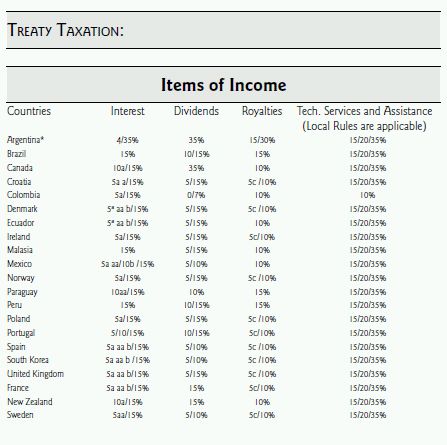

Taxes on certain items of income they receive from sources within the United States. The general Withholding tax rate on technical fees paid to non-residents in Malaysia is 10 and the corresponding Singapore rate is the prevailing corporate tax rate which is presently 17.

.jpg)

Tax Accounting Impact Tax Plan 2019 Pwc Insights And Publications

Iii Where the rate provided in the ITA 1967 is lower than the DTA rate the lower rate shall apply.

Withholding tax rate malaysia dta. I There is no withholding tax on dividends paid by Malaysia companies. RM100000 01 RM10000. Treatment of Income from Property.

See Note 5 for other sources of income subject to WHT. The 8 rate applies to royalties paid for the use of or the right to use industrial commercial or scientific equipment. How to pay Withholding Tax in Malaysia and penalty if not paid.

Withholding tax rate of 10 is only applicable for interest payment paid or incurred by an enterprise in an industrial undertaking. Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence. Double Taxation Agreement Rates.

77 rows Withholding tax is a method of collecting taxes from non-residents who have derived. The payer must within one month after the date of payment to the non-resident remit the withholding tax to LHDN. Dividends interest royalties andor technical fees.

This DTA treatment will give a significant saving of Cambodian withholding taxes of 29 14-1014 29 for Malaysian investors when they repatriate profits back from Cambodia to Malaysia. Malaysian investors can do their own calculations as to which route is best to repatriate profits eg. A 15 withholding tax is required by the sponsor of a non-resident public entertainer before an entry permit can be obtained from the immigration Dept.

WHT Dividends 1. 8 Double Taxation Agreement and Protocols Malaysia has 69 effective Double Taxation Agreements DTA. The United States has tax treaties with a number of foreign countries.

United States Income Tax Treaties - A to Z. Malaysia Corporate - Withholding taxes Last reviewed - 21 July 2021. Lower withholding tax rates Payments of dividends interest royalties and technical fees by a Cambodian company to a Malaysian company are subject to Cambodian withholding taxes at the rate of 14 of the gross payment based on Cambodian tax law.

Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US. Previously With the coming into force of the CAMMAL DTA the withholding tax rates on. For further information please contact us at.

For international payments of services income royalty or rights income interest income capital gains income property rental income and professional services income. I There is no withholding tax on dividends paid by Malaysia companies. Without the treaty the withholding tax rate for interest income paid to non-residents is 15 in Singapore and Malaysia.

Department of International Taxation Headquarters of Inland Revenue Board of Malaysia Level 12 Hasil Tower Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor MALAYSIA. DTA Withholding Tax Rates. For international payments of dividendshare of profits income.

Failing of doing so you may face the potential risks of. Under the DTA the withholding tax on interest in both countries is only 10. Country Fees for Technical Services Bosnia and Herzegovina.

Withholding tax at 15 for non-residents in Malaysia for these services performed. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. The types of payments and withholding tax rates prescribed in Section 70 are.

Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence.

China Tax Rate For Foreigners Taxation On Foreign Employees In China Fdi China

Thailand Taxation Structure Asean Business Partners

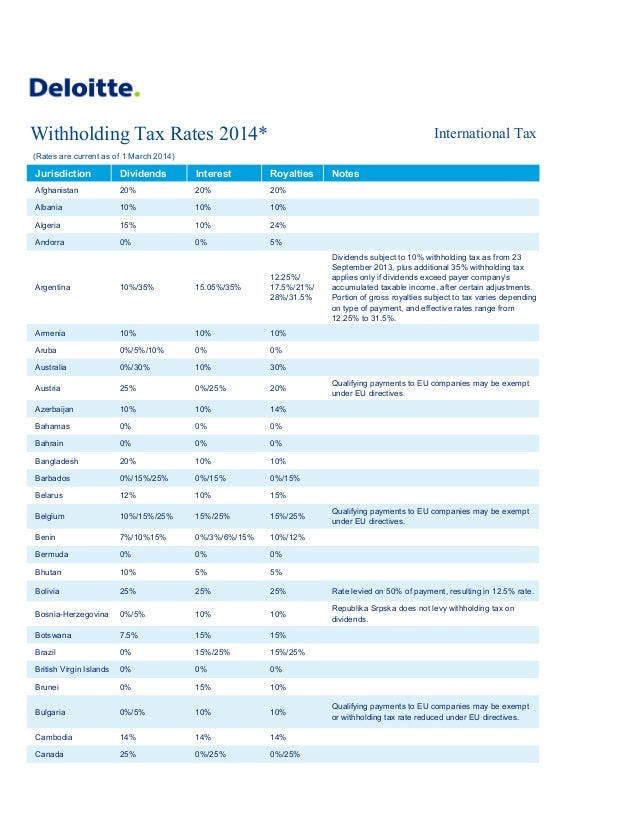

Global Corporate And Withholding Tax Rates Tax Deloitte

Panama Tax Treaties Tax Panama

Managing Corporate Taxation In Latin American Countries Chile Tax Chile

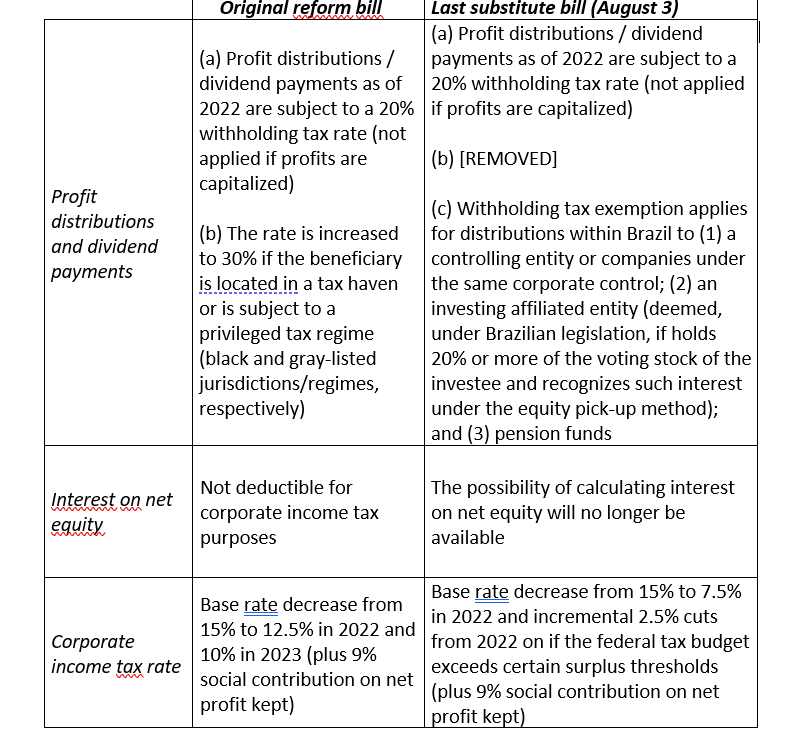

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Global Corporate And Withholding Tax Rates Tax Deloitte

Russia S Double Tax Treaty Agreements Russia Briefing News

Corporate Income Withholding Vat Tax Rates In Countries Along China S Belt Road Initiative Silk Road Briefing

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

.webp)

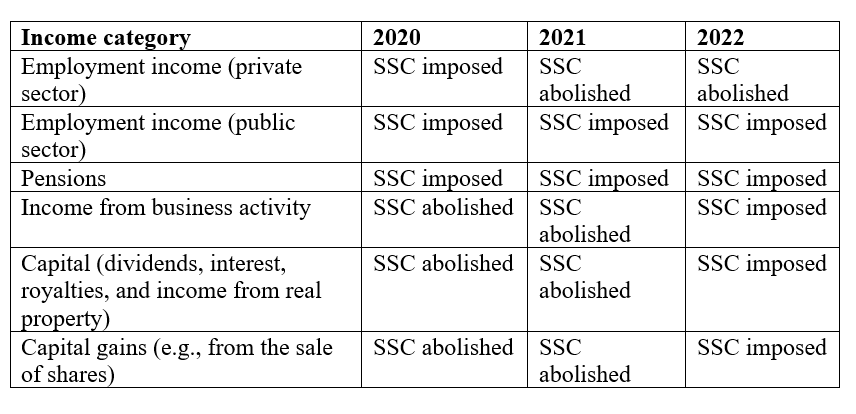

Tax Regulations For Dutch Companies

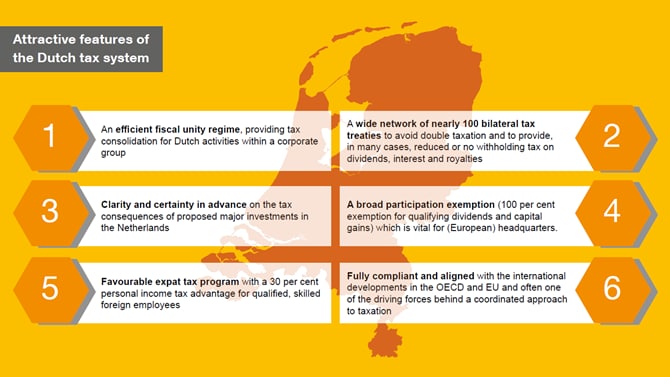

The Withholding Tax System In Thailand Lorenz Partners

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Individual Income Tax In Malaysia For Expatriates

Tax Treaties Database Global Tax Treaty Information Ibfd

Thailand Taxation Structure Asean Business Partners

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Post a Comment for "Withholding Tax Rate Malaysia Dta"