Withholding Tax Rate Maryland

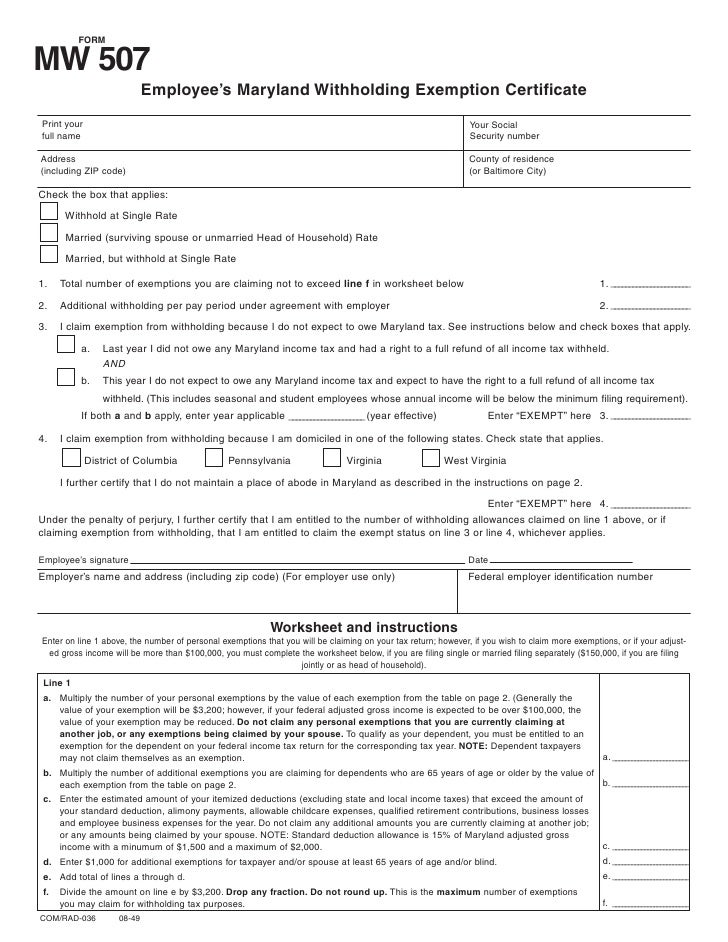

Employees expecting to make more than 100000 in 2021 and who can file as Married or Head of Household should ensure a proper MW507 form is in place for Maryland taxes. The Maryland Comptrollers has released the 2020 state and local income tax withholding percentage and regular methods.

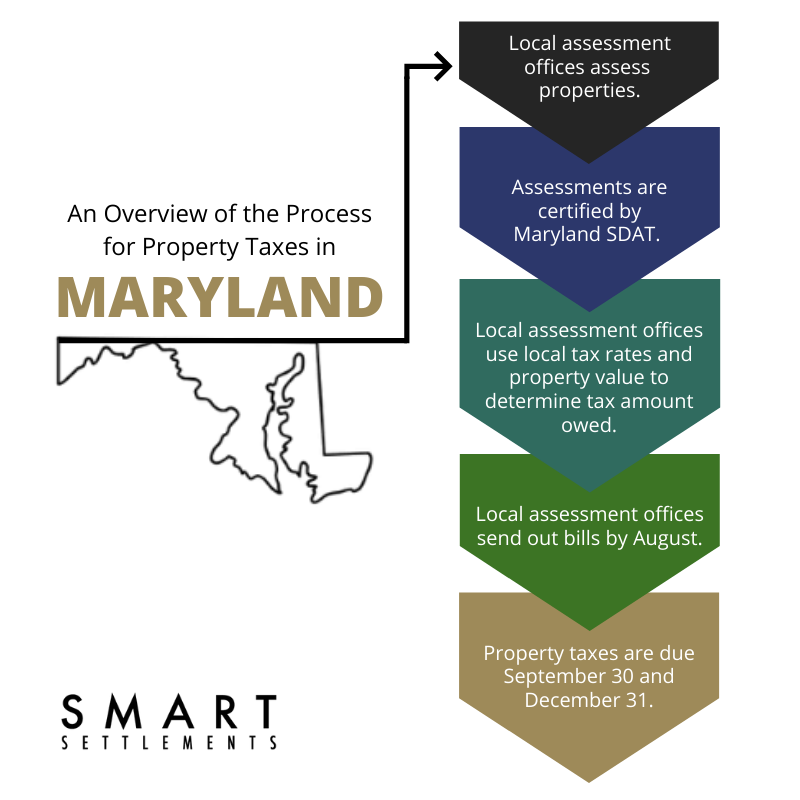

Smart Faqs About Maryland Property Taxes Smart Settlements

The settlement company is required to collect the tax at closing and remit payment along with the deed recording.

Withholding tax rate maryland. Maryland State Retirement Agency staff cannot provide tax advice. The Maryland Legislature may change this tax rate when in session. As of 2019 the withholding tax is 75 for non-resident individuals and 825 for non-resident entities.

The tax formulas for the State of Maryland include the following changes. For Tax Year 2021. The tax rate is the same for all categories until you reach 100000 in yearly income for a single filer.

Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U. 2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate. The minimum standard deduction has increased from 1500 to 1550.

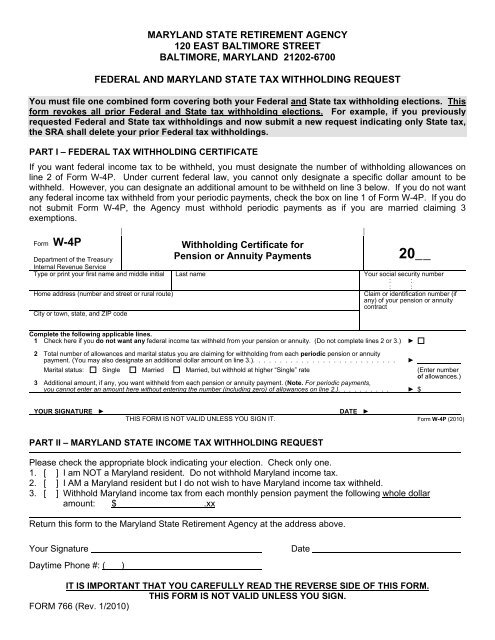

For 2020 the rate of withholding for Maryland residents is 575 plus the local tax rate. Maryland MARYLAND EMPLOYER WITHHOLDING GUIDE This guide is effective January 2020 and includes local income tax rates. You also can update your tax withholding by completing a Federal and Maryland State Tax Withholding Request Form 766.

Exempt military spouse Maryland Payroll Calculators Calculate your Maryland net pay or take home pay by entering your pay information W4 and Maryland state W4 information. Local officials set the rates which range between 225 and 320 for the current tax year. 2021 Withholding Forms 2020 Withholding Forms - current year.

Every August new tax rates are posted on this website. The Maryland bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. 2021 Comptroller of Maryland.

For more information see Nonresidents Who Work in Maryland. The income tax withholding formulas for the State and counties of Maryland have changed. Federal Withholding Tables 2021 As with every other before year the recently modified Maryland Employer Tax Withholding 2021 was released by IRS to prepare for this particular years tax period.

Armed Forces Servicemember Type. For Maryland nonresidents the rate is increased to 80 the resident rate of 575 plus the nonresident rate of 2. A nonresident tax on the sale of Maryland property is withheld at the rate of 8 225 plus the top state tax rate of 575 for individuals and 825 on nonresident entities.

Payors of distributions that are Eligible Rollover Distributions ERDs under IRC Section 3405c subject to mandatory federal income tax withholding are required to withhold Maryland income tax from these distributions paid to Maryland residents at the rate of 775. Maryland has a progressive income tax system with rates that range from 200 to 575. All Maryland counties and the city of.

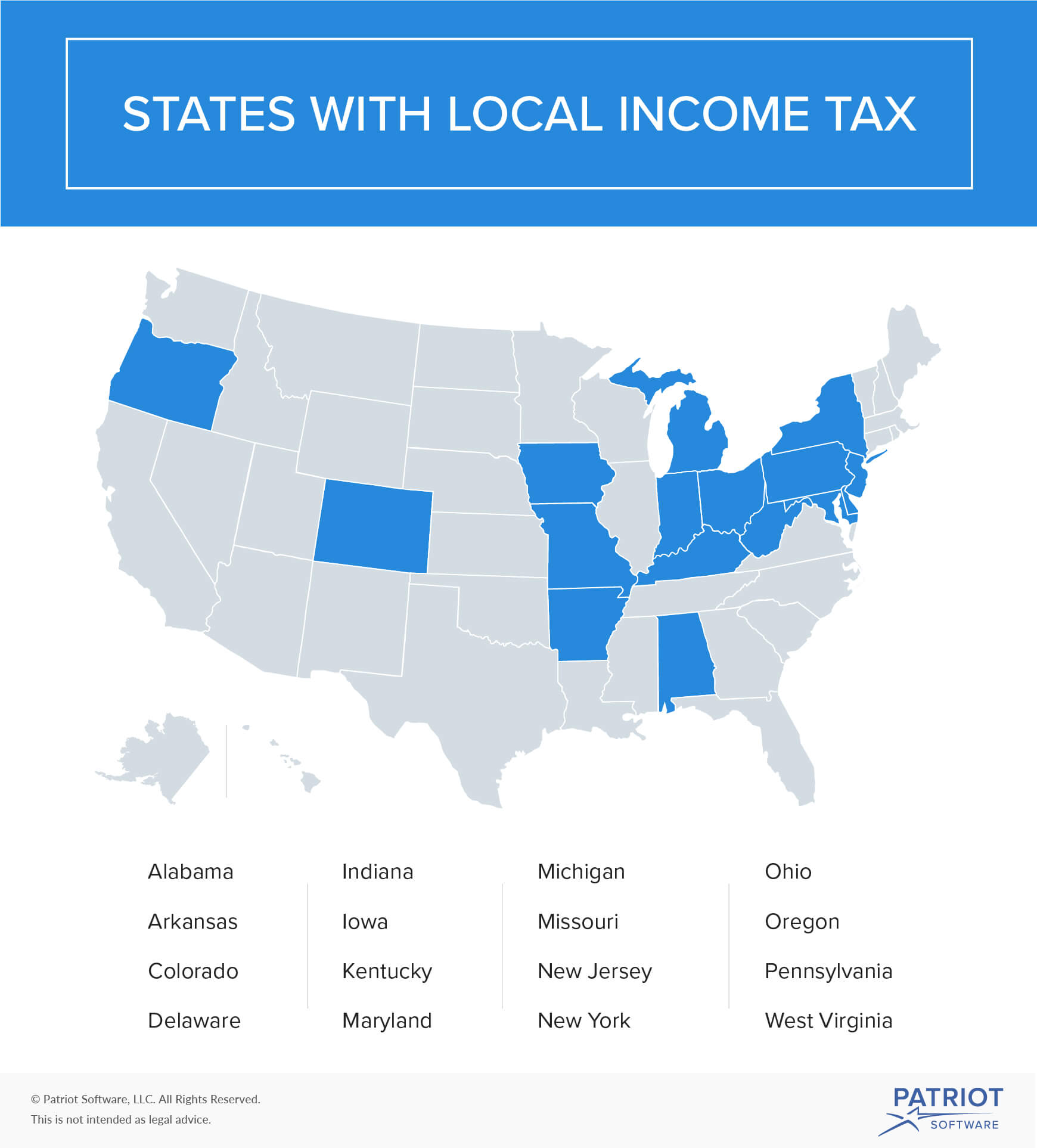

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The Medicare tax withholding is rated at 145. The local income tax is calculated as a percentage of your taxable income.

2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate Carroll County 1018 2515. For more information see Withholding Requirements for Sales of Real Property by Nonresidents. During this time please check our Web site at wwwmarylandtaxesgov for any changes.

Counties are responsible for the county tax rates local towns and cities are responsible for their tax rates and the state is responsible for the states tax rates. Local Income Tax Rates Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. Enter the county in which the employee works.

Anne Arundel County 281 Baltimore County 32 Dorchester County 32 Kent County 32 St. That top rate is slightly below the US. Nonresident local tax rate increased to 225.

Marys County 317 Washington County 320 and Worcester County 225. Status but withhold at the Single rate on MW507 withholding form. The employers match for Social Security and Medicare settlement is included by a 765 rate for the federal government.

It provides several changes such as the tax bracket changes and the tax price each year combined with the option to utilize a computational connection. Nonresident pass-through entity tax rate. If you have specific questions regarding taxes you may wish to consult with a qualified tax.

The maximum standard deduction has increased from 2250 to 2300. Each tax rate is reported to the Department by local governments each year. There is an extra used tax rate as a lot as 009 for an staff member that gains over 200000.

Revised 72320 Page 2 of 7 County and. These rates were current at the time this guide was developed.

About The Maryland Nonresident Withholding Tax Smart Settlements

Federal And Maryland State Tax Withholding Request Form 766

Maryland Income Tax Brackets 2020

Form Mw507m Exemption From Maryland Withholding Tax For A Qualified Civilian Spouse Of Military

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Low Earners Paying More In Taxes Than The Well Off In Maryland Maryland Center On Economic Policy

What Are The Tax Brackets H R Block

2021 Federal State Payroll Tax Rates For Employers

Non Resident Seller Transfer Withholding Tax Raising January 1 2020 Marney Kirk Maryland Real Estate Agent

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Com

Individual Business Rates Of Withholding Tax In Maryland Real Estate Report Oceancitytoday Com

What Is Local Income Tax Types States With Local Income Tax More

State W 4 Form Detailed Withholding Forms By State Chart

Employee S Maryland Withholding Exemption Certificate

The Differences Between Va Md And Dc Taxation Lipsey Associates Of Vienna Virginia

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

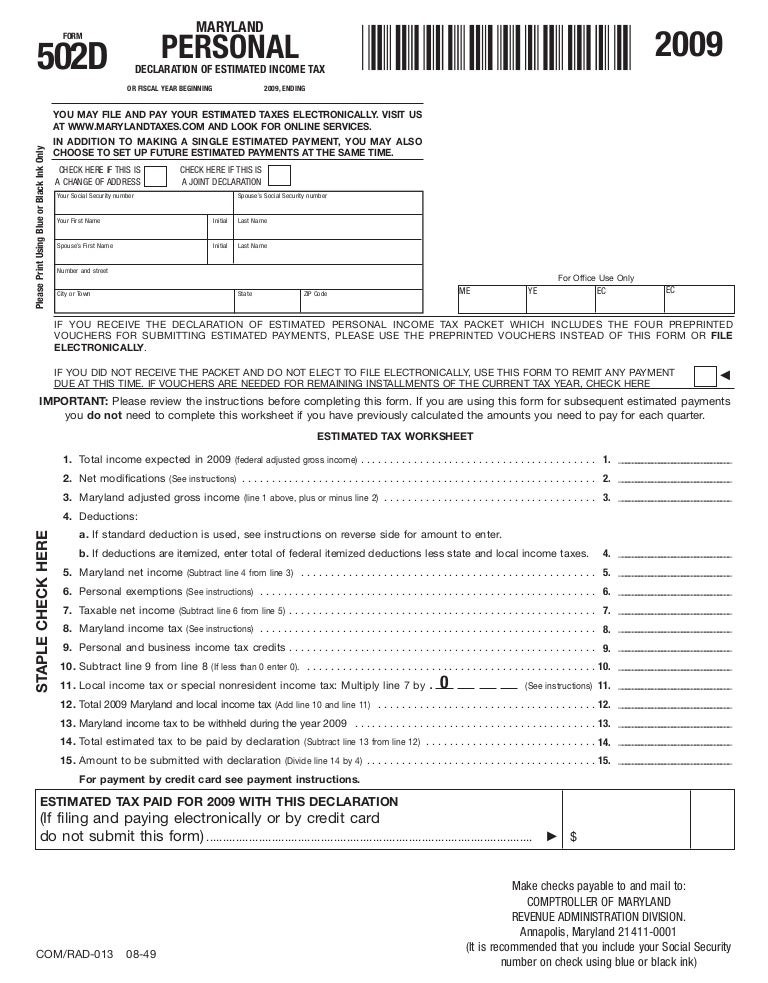

Declaration Of Estimated Maryland Income Tax

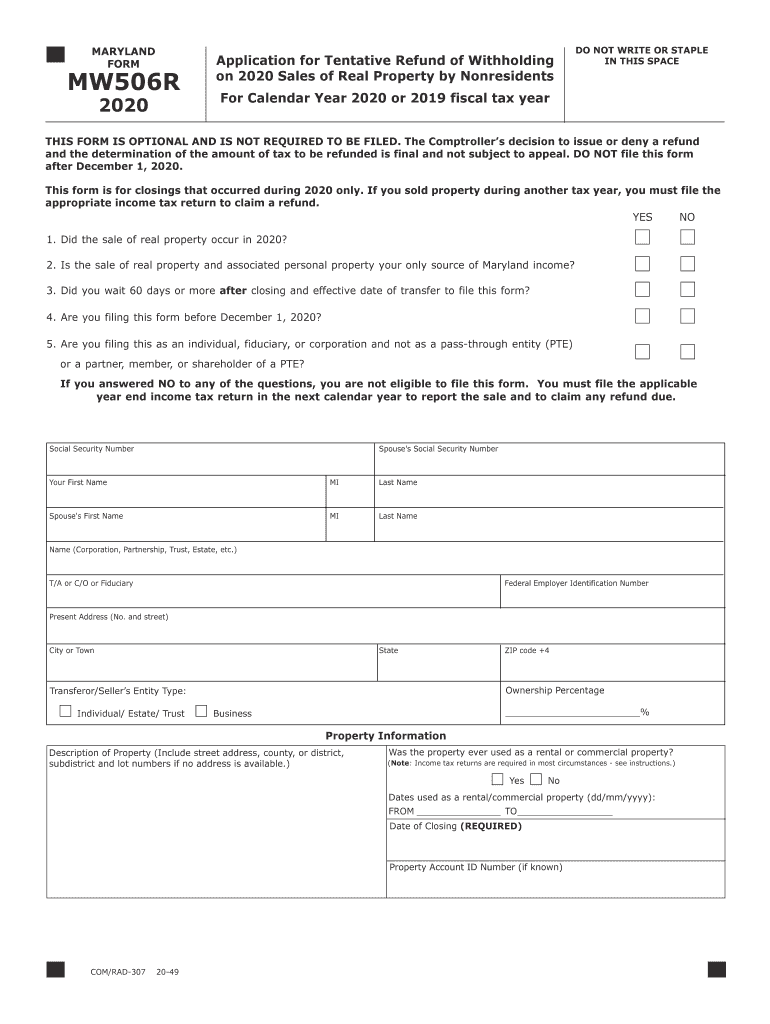

Md Mw506r 2020 2021 Fill Out Tax Template Online Us Legal Forms

Post a Comment for "Withholding Tax Rate Maryland"