Withholding Tax Rates In Ghana 2021

The COVID-19 Health Recovery Levy Act 2021 Act 1068 and the Energy Sector Levy. A withholding agent is entitled to recover the tax.

The Web site of the Ghana Revenue Authority.

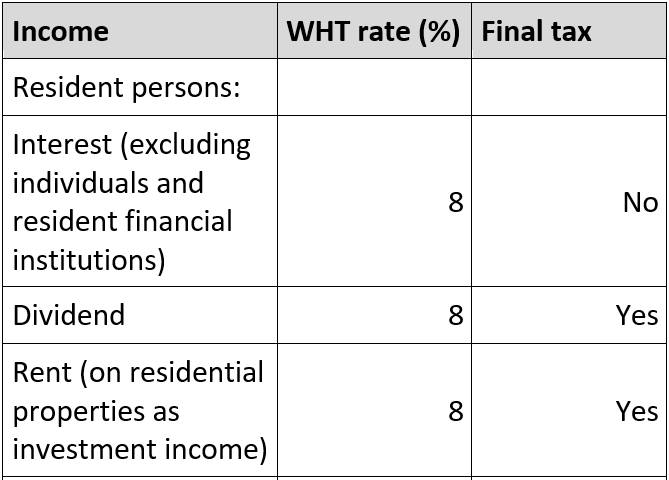

Withholding tax rates in ghana 2021. NHIL Levy fraction 10477. Treaty tax rates 13 Withholding tax under domestic tax laws 14 Exempt income 15 Anti-avoidance schemes Income splitting 15 Transfer pricing 15 Thin capitalisation 16. Residents are subject to tax at rates ranging between 0 and 30 on the following annual graduated scale of income.

It is a tax deducted from an employees income and is paid by an employer on behalf of the employee. The online rates tool compares corporate indirect. Income Tax Regulation 2016 LI.

From USD 11001 to USD 50000 the tax rate is 15. Pay As You Earn. The information contained in this publication is based on the Ghana Income Tax Act 2015 Act 896 and subsequent amendments.

Tax computation NHIL. The company made an all-inclusive tax payable of GH9434000 for the month of May 2021. 2020 Ghana Tax Facts and Figures 6HSWHPEHU 2020.

Ghana 8 South Africa 20 Greece 5 South Korea 22 Hong Kong 0 Spain 19. The Ghana Revenue Authority wishes to inform the general public that following the passage of the Income Tax Amendment No. Branch profits repatriation final non-resident.

The business and investment income of a non-resident person is included in the assessable income for a year of assessment if that income has a source in Ghana. You can calculate your VAT online for standard and specialist goods line by line to calculate individual item VAT and total VAT due in Ghana. One of a suite of free online calculators provided by the team at iCalculator.

Progressive tax rates and brackets for individuals are established on annual income as follows. Withholding Tax Rates Applicable Withholding Tax Rates. Or 15 upon election and the gift does not relate to business or employment.

Where a non-resident person has a Ghanaian permanent establishment PE any income connected with the PE is assessed to tax. The general corporate income tax CIT rate is 25. In a bid to increase the effectiveness of tax administration and the collection of taxes in Ghana the Parliament of Ghana has passed into law an amendment called Revenue Administration Amendment Act 2020 Act 1029 which was gazetted on 6 October 2020.

Rates Online Tax Rates Online. Personal income tax rates. Headline gift tax rate Gift is included in the income of the individual and taxed at 25 for a non-resident and the marginal rate for a resident.

Ghana Withholding Tax Rates - This video presents a summary of withholding tax rates in Ghana for both resident and non-resident persons in roughly 80 seco. The higher rate applies in any other case. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Not yet in force. GH9434000 excluding the tax. Dzolali Limited is a VAT registered textile manufacturing company approved by the Ministry responsible for Trade and Industry.

Withholding Tax Rates in Ghana. New Tax Policies And Amendments. PwC Introduction In this publication all currency references are.

The National Pensions Act 2008 Act 766 National Pensions Amendment Act 2014 Act 883 Guidelines for the Registration of. The Ghana VAT Calculator is updated with the 2021 Ghana VAT rates and thresholds. From USD 0 to USD 11000 the tax rate is 0 exempt.

From USD 50000 and over the tax rate is 25 on. A withholding agent shall file and pay to the Commissioner-General within fifteen 15 days after the end of the month a statement in the prescribed form and tax withheld. Updated up to June 30 2021.

2 Act 2018 Act 979 the following amendments have been made to the Income Tax Act 2015 Act 896The Income Tax Amendment No. Compute the relevant NHIL Levy tax payable. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10.

5 for non-resident banks. Ghana has DTTs with the following countries for the relief from double taxation on income arising in Ghana. Non-residents are liable to Ghanaian income tax on any income derived in Ghana from any trade business profession or vocation or which is derived from an employment exercised in Ghana.

10 in any other case. The Commissioner-General of the Ghana Revenue Authority brings to the notice of the general public especially taxpayers that Parliament has passed three new tax laws and amended two existing laws to be implemented in 2021. 2 Act 2018 Act 979 has provided for new rates applicable to Resident Individuals.

The lower rate applies where the recipient holds at least 10 of the shares. The tax is charged on all income of an individual in employment whether it is received in cash or in kind. A withholding agent who fails to withhold the tax shall be liable to pay the tax.

Monthly PAYE returns must be filed by the employer on behalf of employee on or before the fifteenth day of the month. Inheritance tax is not expressly and separately provided for under the tax laws of Ghana.

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

What Is The Withholding Tax Rate In Ghana

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

How To Calculate Income Tax In Excel

Taxation Lectures Tax Administration In Ghana Part 1 Taxation In Ghana Youtube

What Is The Percentage Of Withholding Tax In Ghana

The Embassy Of The Republic Of Ghana Berlin Germany Akwaaba Welcome To Ghana The Safest Friendliest Most Affordable English Speaking Country In Africa

Tax Training Taxation Of Government Ministries 26 May 2016 At Ksg Ppt Download

What Is The Percentage Of Withholding Tax In Ghana

Withholding Tax Rates By Country Money Master Tutorials

Finland Changes To Legislation Regarding Nominee Registered Shares Wts Global

Guidelines For Tax Compliance In Ghana All You Need To Know About Taxes In Ghana

Taxation Lectures Tax Administration In Ghana Part 1 Taxation In Ghana Youtube

The Embassy Of The Republic Of Ghana Berlin Germany Akwaaba Welcome To Ghana The Safest Friendliest Most Affordable English Speaking Country In Africa

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Post a Comment for "Withholding Tax Rates In Ghana 2021"