What Is Withholding Tax In Tanzania

Here are some of the taxes administered under the taxation system in Tanzania. Also withholding tax would not apply if the income or the.

Tanzania Vs African Barrick Gold Plc August 2020 Court Of Appeal Case No 144 Of 2018 2020 Tzca 1754 Tpcases Com

If you are a corporation and you pay dividends to shareholders you must withhold tax from this dividend payment.

What is withholding tax in tanzania. This is a final withholding tax and satisfies the employees liability. VAT is accounted for monthly. Temporary employees from abroad you should withhold at a rate of 15 of income from employment.

The domestic WHT rate applies unless the DTT rate is lower in which case the lower DTT rate applies. WHT is a tax levied on the payer of an item of income and could if not properly planned have a significant impact on company profit levels. A Withholding tax also called a Retention tax is a government requirement for the payer of an item of income to withhold or deduct tax from the payment and pay that tax to the government.

Non-residents are taxable on income with a source in Tanzania. Are taxes which the withholdee is entitled for a tax. Where these payments are made by individuals not conducting a business the recipient is liable to pay the tax by way of assessment.

The lower rate applies if the beneficial owner is a company that controls directly or indirectly at least 15 of the voting power in the company. As a general rule resident individuals not in business in Tanzania do not have obligation to collect withholding tax when making payments for any of the specified incomes. Equity has been defined to mean paid-up share capital paid-up share premium and retained earnings on an unconsolidated basis determined in accordance with generally accepted accounting principles.

Certain payments to non-residents are subject to tax at the. Where the recipient is a resident corporation which holds 25 or more of the shares and voting power in the dividend paying corporation there is generally no withholding tax and the payment is exempt. However the effects of withholding tax WHT on the profit of the company is not usually one of the things thought of until it is too late.

Withholding tax is the amount of tax retained by one person when making payments to another person in respect of goods supplied or services rendered by the payee. The following example illustrates how quickly WHT can go wrong. - Withholding Taxes on Capital incomes Direct taxes account for 30 of total tax revenue Indirect Taxes Levied on international trade transactions and domestically produced goods and services Account for 70 of total tax revenue Tax structure has undergone significant reforms for fairness simplicity equityefficiency and taxpayer.

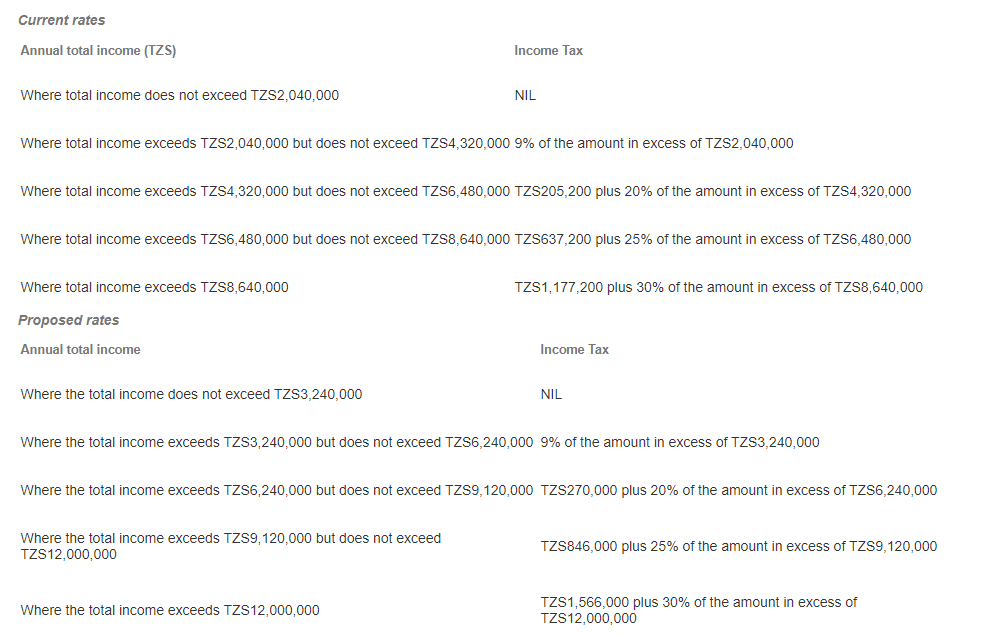

Withholding tax arrangement applies to individuals deriving income solely from employment PAYE and also to non-resident taxpayers with Tanzania source income. Income tax is charged at a rate of 30 on income of a resident corporation and of a permanent establishment PE of a non-resident corporation or 5 of turnover for technical and management service providers to mining oil and gas entities deducted by way of WHT. In Tanzania the income tax law also places withholding tax obligation on the payer of some specified types including service fees and professional service fees.

Kenya Uganda Tanzania Rwanda and Burundi require that anyone making payments to suppliers for the provision of goods and services whether resident or non-resident should withhold tax at the appropriate rates see Annex 1 and remit this tax to the respective Revenue Authority. Prior to July 2016 withholding tax WHT only applied to such payments either where services were rendered in Tanzania or where the payer for the services was the Government of Tanzania then irrespective of place of performance. Interest tax is withheld in Tanzania.

A person receiving or entitled to receive a payment from which income tax is required to be withheld is a withholdee while a person required to withhold income tax from a payment made to a withholdee is referred to as the. A Tanzanian entity should have withheld 15 tax from its payments to a non-resident for the analysis of raw seismic data which was carried out outside the country as payments for services that were sourced from Tanzania. In Tanzania Withholding tax applies mostly to employment income.

Businesses in Tanzania are required to withhold tax on various payments including payments for service fees to nonresident service providers. 60 Types of withholding tax Final Withholding Taxes are taxes in which the withholdee cannot claim any tax credit when calculating the income tax payable for a year of income. Inheritances and donations There are no inheritances donations or gift taxes in Tanzania.

The income tax base in Tanzania is still narrow. DIRECT TAXES Corporate taxes. Withholding tax is tax paid in advance from employment income business income and investment income non- final withholding tax or Is final tax paid from final withholding payments as provided for under section 86 of Income Tax Act 2004.

TRA demanded withholding tax on the payments to Ireland and South Africa on the grounds that they were Tanzanian sourced income. For non resident employees eg.

Https Starbucksbeanstock Com Wp Content Uploads 2019 11 Pis Tanzania Bean Stock Rsu Eng Fy20 Pdf

Tanzania Finance Act 2019 Activpayroll

Tanzania Business Expense Deduction Activpayroll

Tanzania Revenue Authority Iso 9001 2008 Certified Tra Tanzania Revenue Authority Tanzania Pdf Document

Tanzania Revenue Authority Iso 9001 2008 Certified Tra Tanzania Revenue Authority Tanzania Pdf Document

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Chapter 332 The Income Tax Act Tanzania Revenue Free Download Pdf

Tanzania Revenue Authority Ppt Download

Taxation In Tanzania Direct Corporate Others Unitedrepublicoftanzania Com

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Https Abgpersonas Com Wp Content Uploads 2021 03 Tanzania Ias Pholio Pwc Pdf

The Income Tax Act Tanzania Investment Centre

Taxation In Tanzania Cdr Tanzania Investment Forum

Tanzania Revenue Authority Iso 9001 2008 Certified Tra Tanzania Revenue Authority Tanzania Pdf Document

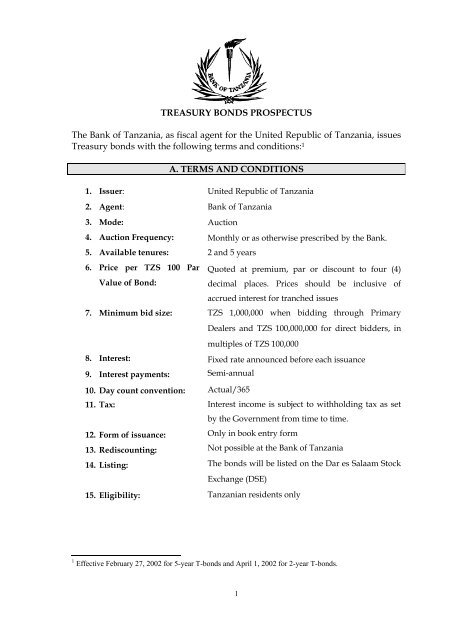

Treasury Bonds Prospectus Bank Of Tanzania

Pin On Teaching Social Studies

Tanzania S Parliament Passes Finance Bill 2020 Ey Global

Taxation In Tanzania Direct Corporate Others Unitedrepublicoftanzania Com

In Review Direct Taxation Of Businesses In Tanzania Lexology

Post a Comment for "What Is Withholding Tax In Tanzania"